CICC Solely Assists Viva Biotech in Listing on the Main Board of HKEx

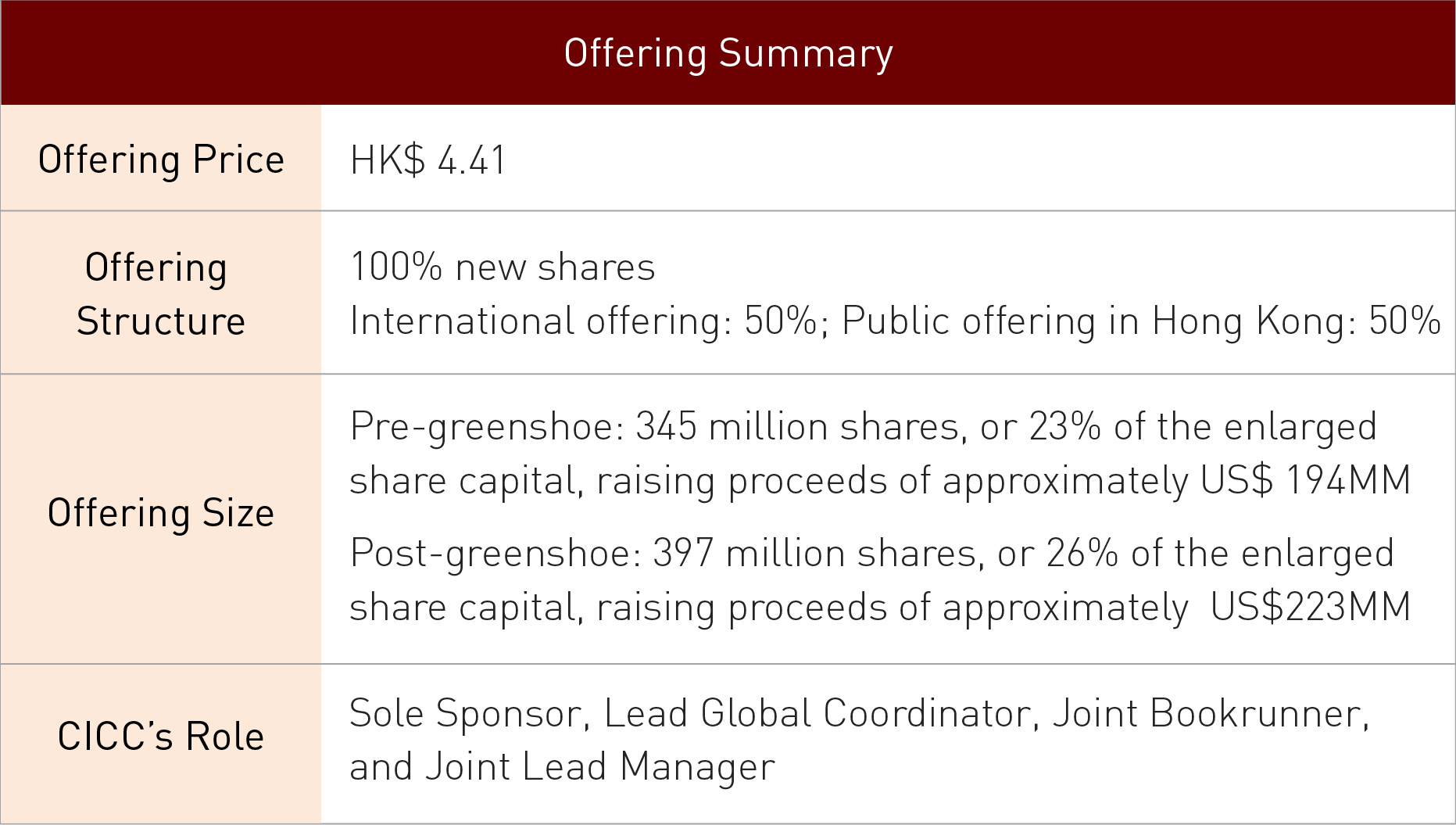

Viva Biotech Holdings (“Viva Biotech” or “the Company”,1873.HK) is successfully listed on Hong Kong Stock Exchange on May 9th, 2019. The pre-green shoe offering size is US$ 194 million and the post-green shoe offering size is US$223 million (the Offering). CICC acted as Sole sponsor, Lead global coordinator, Lead bookrunner, and lead manager.

Viva Biotech is the first company listing on HKEX with the main business of innovative “CRO + incubation” model, the deal has set a record of the highest HKPO subscription multiples in biopharmaceutical industry since 2016 and has achieved high-end pricing in the challenging market environment. Since the new listing policy adopted by HKEx in 2018, the only 2 solely-sponsored biopharmaceutical companies were both sponsored by CICC and both had great success in global offering.

Viva Biotech was established in 2008. It operates a leading structure-based, integrated drug discovery platform in terms of revenue in 2018 and beam time for synchrotron radiation in 2018. Viva Biotech provides structure-based drug discovery services to over 370 biotechnology and pharmaceutical customers worldwide for their pre-clinical stage innovative drug development. On this basis, the Company innovatively combines the conventional cash-for-service (CFS) model and the unique equity-for-service (EFS) model. With the combination of CFS and EFS model, Viva Biotech has achieved the leap from CRO business to the trillion-dollar pharmaceutical market and become a cradle for promising biotechnology start-ups.

With abundant experience and years of work in the industry, Viva Biotech has established an excellent reputation in the industry. The customers include nine out of the top 10 global pharmaceutical companies (in terms of revenues in 2018), as well as 23 biotechnology companies named in the Fierce Biotech Top 15 Promising Biotechs. As for EFS model, Viva Biotech now has almost 30 incubation team members including internal world-class scientists and business partners consisting of world’s top scientists from renowned global pharmaceutical companies and other prestigious biomedical research institutes. As of the Latest Practicable Date, Viva Biotech has 31 biotech companies in incubation portfolio, 11 of them had completed private financing rounds. The incubation portfolio companies mainly focus on first-in-class drugs for unmet medical needs.

CICC took the lead in each work line to ensure the overall progress of the execution. It only took 4 months from the project kick-off to A1 submission including the process of Pre-IPO financing. CICC helped Viva Biotech, the first company with “CRO + incubation” business model to make investment story and build up great momentum in global offering, with more than 100 international investors participated in the International Offering and over 100 times of HKPO subscription to trigger the highest percentage of clawback. By leveraging its abundant domestic and international resources and exploring investors’ needs, CICC solely introduced all cornerstone investors and contributed more than 80% demands of International Offering, including international long term funds, large insurance institutions, famous industry investors, well-known hedge funds and professional healthcare investors. CICC also successfully helped the Company to overcome challenges of market environment to achieve high-end pricing. CICC successfully ensured the offering and was highly recognized by the Company, reflecting the absolute leading edge and independent leading ability of CICC in overseas healthcare industry IPO.

As a leading investment bank with “China Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.