As a platform covering all time zones and currencies, CICC provides bond underwriting and distribution services to central and local governments and policy-based financial institutions, market liquidity and high-frequency quotation services as a market maker, and customized solutions for interest rate products and derivatives.

Full-Service Platform

We provide domestic and overseas enterprises and institutions with integrated and comprehensive services such as sales, trading and market making of fixed income, commodity and foreign exchange securities as well as derivatives, including interest rate business, credit business, structured product business (covering securitized products and non-standard products), foreign exchange business and commodity business (including futures business).

CICC FICC (Fixed Income, Currencies and Commodities) is committed to building a platform covering all time zones, different markets and multiple products. Our business reaches various major domestic and overseas investors in bonds, commodities and foreign exchange products, and has built experienced sales teams in both domestic and overseas markets.

As a top-tier dealer and market maker in China’s fixed income market, our trading team provides advanced trading methods and two-way price quotes (bid-ask quotes) for cross-market products. We have built and maintained strong relationships with major investment institutions and provide high quality trading services for our clients.

We have built a comprehensive platform for the FICC business in terms of risk-taking and hedging, customer transaction service, product design and issuance, and cross-border transaction execution. We design and provide customized and integrated product solutions for domestic and overseas clients through the interconnected product platform to help them with cross-border trading and risk management.

Achievements

Top-tier Dealer in the RMB Fixed Income Market

▲ Member of the underwriting syndicate for all 37 LGB issuers

▲ Leading Public REITs Market Maker

▲ Named bond market leader by China Central Depository & Clearing Co., Ltd. (CCDC) in 2023

Thriving International Business

▲ 2023 Bond Connect Northbound Top Market Maker

▲ 2023 CIBM Participants Performance Evaluation - Top Contributor of International Business

▲ Top1 Chinese offshore dollar bond underwriter among Chinese brokerages

Advancing Green and Sustainable Development on All Fronts

▲ Received No-Objection Letter (NOL) for proprietary carbon emissions trading

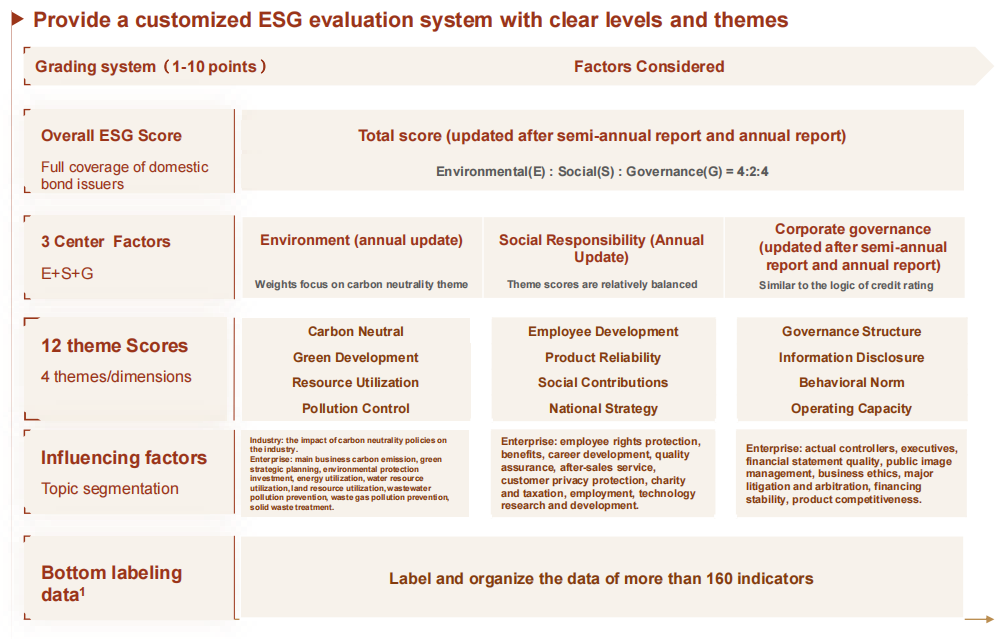

▲ 2023 CIBM Participants Performance Evaluation - Top Contributor of ESG Business

▲ Received Excellent Trading Performance Award in the First National Carbon Market Simulation Trading Competition of Shanghai Environment and Energy Exchange

Major Innovations

▲ First-in-market innovations: completed the first H-share full-circulation and FX spot transaction bundles in 2023 and the first interbank market green asset-backed note-linked multi-name CDS business in addition to a number of other firsts

▲ The “Insurance + Futures” project was successfully included in XINHUANET “2023 Excellent ESG Cases of Enterprises”

▲ The “Carbon for Ecological Value” model was included in “2023 Excellent Inclusive Finance Cases (Innovative Model) of People’s Daily Online” and listed in 2023 Excellent Cases of Empowering Rural Revitalization through Financial Development