CICC Assists ICBC Offshore Branches in Multi-Currency Senior Green Notes Issuance

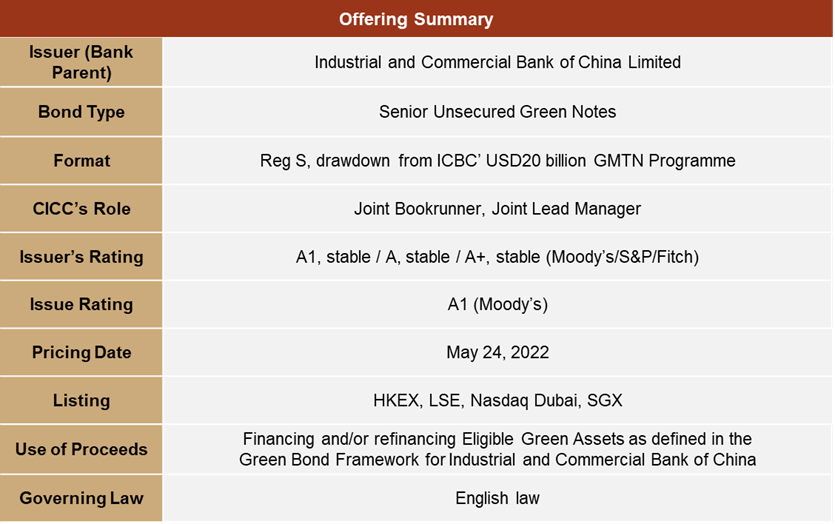

On May 24, 2022, Industrial and Commercial Bank of China Limited (“ICBC” or the “Company”, issuer rating A1/A/A+ (Moody’s/S&P/Fitch)) successfully completed its issuance of global multi-currency offshore “Carbon Neutrality” Themed Green Notes via offshore branches (the “Issuance”), with an issue rating of A1 (Moody’s). CICC acted as Joint Bookrunner and Joint Lead Manager in all the 5 tranches. The 5 tranches were:

- ICBC Hong Kong’s 3-year 2.950% coupon U.S.$1.2 billion Senior Unsecured Fixed Rate Green Note, with an issue yield of 3.025%

- ICBC Hong Kong’s 2-year 2.950% coupon/issue yield HKD2.0 billion Senior Unsecured Fixed Rate Green Note

- ICBC Dubai’s 2-year 3.200% coupon/issue yield CNY2.0 billion Senior Unsecured Fixed Rate Green Note

- ICBC London’s 3-year 1.625% coupon EUR300 million Senior Unsecured Fixed Rate Green Note, with an issue yield of 1.636%

- ICBC Singapore’s 3-year SOFR+75bps coupon/issue yield U.S.$600 million Senior Unsecured SOFR-based Floating Rate Green Note

The green notes have been certified as “Carbon Neutrality” Themed Green Bonds by Beijing Zhongcai Green Financing Consultant Ltd. and have been certified as Carbon Neutrality Green Bonds according to the requirements of Green and Sustainable Finance Certification Scheme by Hong Kong Quality Assurance Agency. The proceeds of the Issuance will be used in financing and/or refinancing Eligible Green Assets as defined in the Green Bond Framework for Industrial and Commercial Bank of China, especially the selected eligible renewable energy and clean transportation projects with expected substantial carbon emission reduction benefits. ICBC is committed to practicing and promoting the development of eco-civilization, and it is working to achieve the goals of carbon peaking and carbon neutrality through all-round green financial activities.

The simultaneous, multi-currency and multi-region issuance was highly sought after by investors. Despite the headwinds of high inflation in the US and Europe, high expectations of the US Fed’s rate hikes and surging US Treasury yields, JLMs accomplished all the execution work efficiently and assisted the Company to capture the optimal market window to launch the issuance and finish bookbuilding on the same day, delivering an impressive pricing result. The overall orderbook of the issuance reached 3.0x over-subscription, leading to 2.68 billion USD equivalent, being the largest one-time offshore senior notes issuance by a Chinese bank this year. The issue yields and the issue spreads of the issuance ranked the best among peers, showing the excellent underwriting strength of CICC.

- ICBC Hong Kong’s USD note: The orderbook reached over US$4.9bn, which represents 4.1x over-subscription. The final price guidance for the note was T+38bps, significantly tightened 47bps from the IPG.

- ICBC Hong Kong’s HKD note: The orderbook reached over HK$6.4bn, which represents 3.2x over-subscription. The final price guidance for the note was 2.95%, significantly tightened 40bps from the IPG.

- ICBC Dubai’s CNY note: The orderbook reached over CNY14.1bn, which represents 7.1x over-subscription. The final price guidance for the note was 3.2%, significantly tightened 55bps from the IPG.

- ICBC London’s EUR note: The orderbook reached over EUR760mm, which represents 2.5x over-subscription. The final price guidance for the note was MS+50bps, 20bps tighter than the IPG.

- ICBC Singapore’s USD SOFR-based note: The orderbook reached over US$1.8bn, which represents 3.0x over-subscription. The final price guidance for the note was SOFR+75bps, significantly tightened 40bps from the IPG.

CICC has built a sound and long-lasting partnership with ICBC and has assisted the Company in many transactions in the past years. In every of the 5 tranches, CICC contributed a large number of high-quality allocable cornerstone orders at the beginning of the book opening on the pricing date, making outstanding contributions to the ideal results. CICC assisted the Company to issue all the notes efficiently and successfully, gaining high praise from the Company. The successful transaction deepened the cooperation between CICC and the Company, which built a solid foundation for the further cooperation.