CICC Solely Assists Gemdale in Reoffering USD300mm Offshore Bond

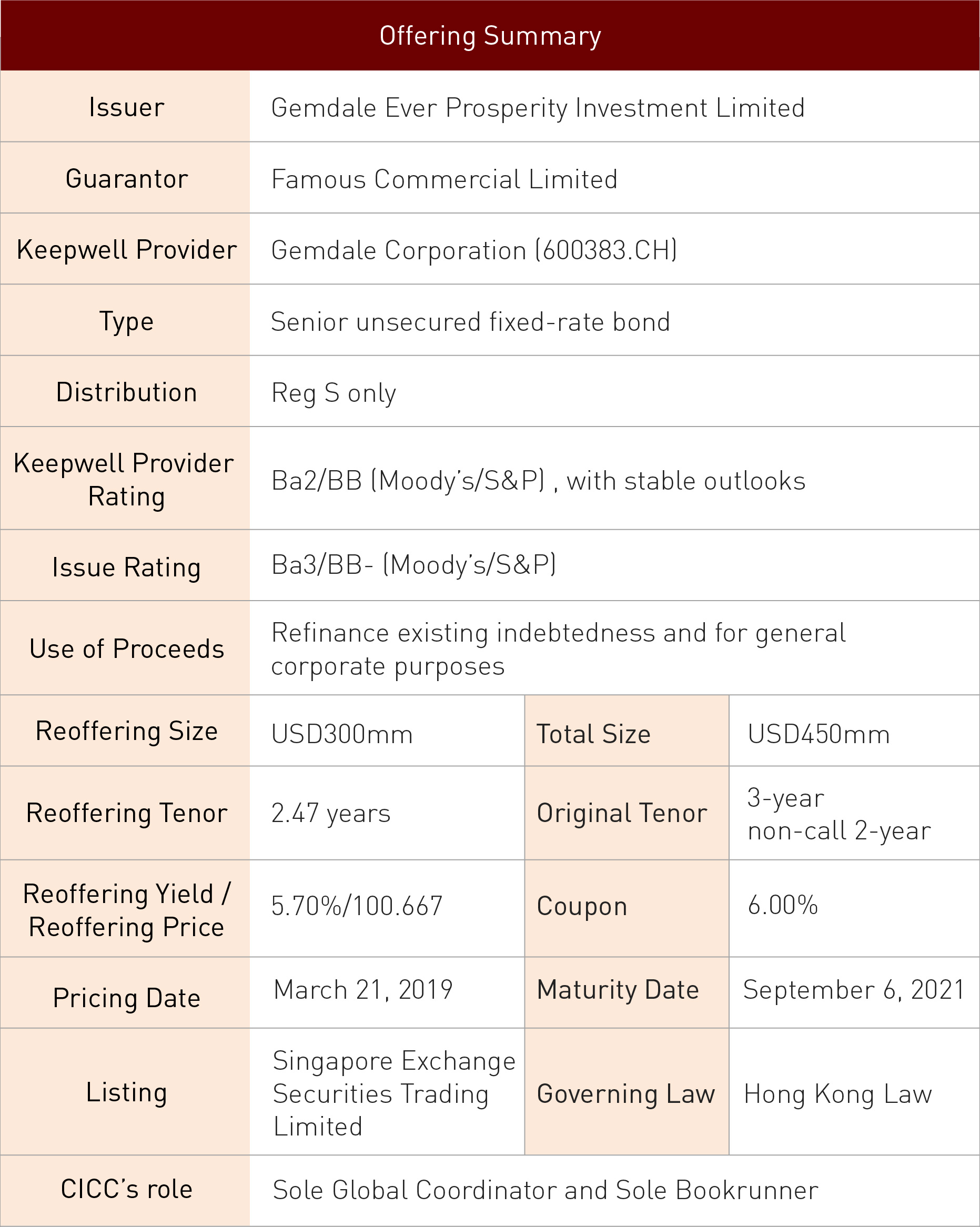

On April 1, 2019, CICC, acting as the Sole Global Coordinator and Sole Bookrunner, assisted Gemdale Corporation (“Gemdale” or “the Company”) to successfully complete its USD300mm reoffering (“this issuance”), at a reoffering yield of 5.70%, a coupon of 6.00% and a reoffering price of 100.667. This issuance is a tap on the original bond due 2021 with an original tenor of 3-year non-call 2-year and a reoffering tenor of 2.47 years.

Established in 1988 with headquarter in Shenzhen, Gemdale Corporation commenced its real estate business in China in 1993. The Company was listed on the Shanghai Stock Exchange in 2001 (stock code: 600393.SH) and is one of the earliest real estate companies which have been listed and established a national network. Gemdale has been awarded the "Blue Chip" Award for 15 consecutive years.

Acting as the Sole Global Coordinator, CICC helped the Company to effectively finish all the preparation work of bond issuance within one week and accurately grasp the optimal issuance window to launch the transaction after the Fed released the resolutions of FOMC meeting in March, which is a core prerequisite for the success of this issuance. CICC closely coordinated with agencies and completed due diligence, transaction document preparation, marketing promotion, and etc. in a very short period of time. The efficient execution ability and professional service attitude were highly praised by the Company.

On the pricing day, CICC assisted the Company to launch the transaction with initial price guidance of 6.125% area and also hold roadshow conference call in the morning, attracting various high-quality investors. Based on the excellent marketing strategies, this issuance was warmly welcomed by the market and a great number of high-quality funds, sovereign funds and banks participated in the subscription. Within 2 hours after the opening, the book exceeded USD1.0bn and hit USD2.3bn at the peak, leading to a 7.5x over-subscription and also representing the investors’ high recognition of Gemdale’s outstanding credit. Based on the strong order book, this issuance was finally priced at 5.70%. The pricing significantly narrowed 42.5bps from the initial price guidance, which is one of the largest narrowing scales among recent bond issues in Asian market.

CICC has served Gemdale Corporation for a long term and has engaged in various material transactions of Gemdale since 2007, including A-share non-public offerings in 2007 and 2009, the issuances of corporate bonds in 2008, 2015, 2017 and 2018 and offshore USD bonds in 2017 and 2018. This issuance is another important financing service in the capital market provided by CICC for Gemdale, which further consolidates the long-term good cooperation relationship between two parties.