CICC Leads Nanjing Yangzi USD500 million 5-years Senior Bond Issuance

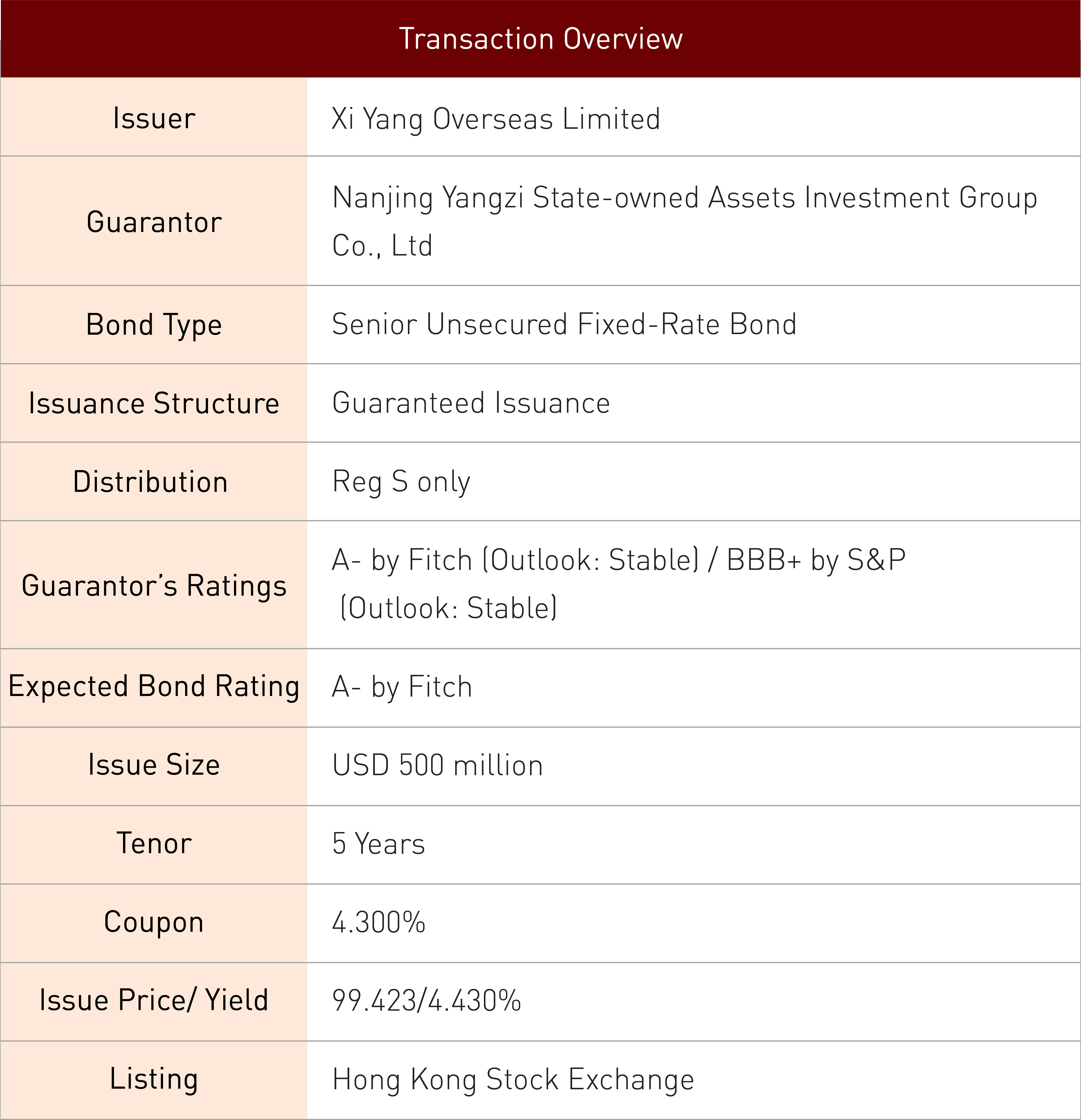

CICC, acting as lead Global Coordinator and Bookrunner, successfully assisted Nanjing Yangzi State-owned Assets Investment Group Co., Ltd (“Nanjing Yangzi” “NYSI” or the “Company”) to complete its second international bond issuance of 5-year 4.300% coupon USD500 million Senior Fixed-rate Notes on May 29, 2019 (the “Issuance”). The Company is the only state-owned enterprise in Jiangsu province granted A-level grade ratings from international rating agencies and successfully issued international bond. The Issuance has achieved breakthroughs in both tenor and cost perspective. On the backdrop of US treasury rate moved downward, the company accurately seized a favorable issuance window and locked a relatively flat yield curve, resulting in an overwhelming market response to the five-year notes and achieving low-cost financing in medium-to-long-term tenor. The bond issuance rate has also set a new record low for the five-year senior bond compare to other state-owned enterprises year-to-date, setting a new market benchmark in the market. The Issuance is also the first Chinese LGFV bond with highest A-level rating to issue 5-years in 2019 YTD. The Issuance, as a significant milestone of NYSI, strengthened the Company’s financing channel in international capital markets and favorable funding cost, fully displaying its credit highlights of Nanjing Municipality, Jiangbei New District and the Company to international market.

Established in April 2014, Yang Zi Investment Group is a wholly state-owned company funded by the Nanjing Municipal Government, with the Administrative Committee of Jiangbei New District authorized to perform relevant investor functions. The Company's registered capital reached RMB7.8bn. The Company is the only state-owned assets building and operation platform and the largest infrastructure and public utilities service platform in Jiangbei New District. It is also the unified investment and financing platform for shantytown reconstruction across Nanjing, and the largest local government financing platform in Nanjing by total assets. The Company is responsible for the investment in major functional projects and the industrial transformation and upgrade in the Jiangbei New District. The company’s total assets reached RMB206.3bn and generated an operating income of RMB7.2bn in 2018.

The Company achieved favorable funding cost with a relatively long tenor through effective marketing and optimal issuance strategy. The Company had in-depth discussions with near 100 institutional investors during three-day global roadshow. At the same time, the Company also took this opportunity to vigorously promote the development achievements of Jiangbei New District in recent years to the overseas market audiences. This has helped the Company’s existing secondary bonds’ price to trade up and to secure significant high-quality anchor orders before book open. Post roadshows, CICC maintained close communication with investors and monitored market conditions to seize an optimal issuance window by capturing the downward US treasury movement and locked a relatively flattening yield curve, resulting an overwhelming market response to the five-years Notes. The orderbook reached over USD2.5 billion at peak, which represents 5x over-subscription. On the back of strong orderbook, the final pricing was tightened 37 bps from the initial price guidance of 4.8% area.

As lead Global Coordinator, CICC successfully assisted and guided NYSI to efficiently completed the execution process including regulatory approval, due diligence, documentation, ratings, roadshow logistics, marketing and distribution, settlement etc. CICC has shown efficient execution capability by only taking 1.5 months to complete the project. CICC was highly praised by the Company on our excellent project execution ability which made outstanding contributions to the success of this Issuance. The outstanding issuance is another successful case study of CICC on the offshore bond issued by large state-owned enterprises in Nanjing, Jiangsu Province, following Sichuan Province and Yunnan Province, etc. This deal is, once again, another milestone transaction in the international bond capital market. Since CICC and NYSI’s debut cooperation in 2017 on their first international bond issuance, this has been the second cooperation which further solidifies the leading position of CICC in the international debt capital markets.