CICC Assists Xinjiang Zhongtai (Group) Co., Ltd. Debut 3-year USD380 million Senior Bond Issuance

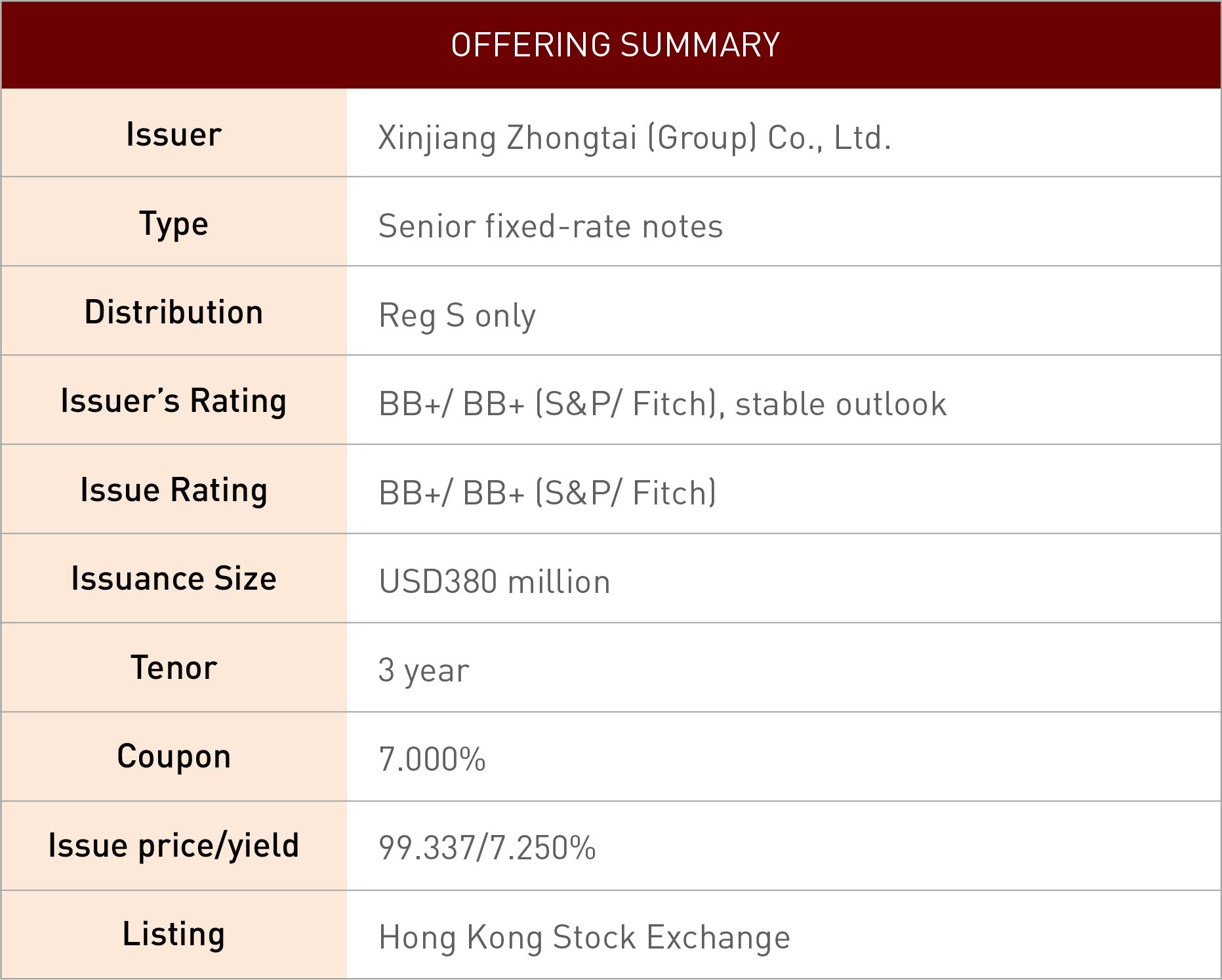

CICC, acting as sole Rating Advisor, lead Global Coordinator and Bookrunner, successfully assisted Xinjiang Zhongtai (Group) Co., Ltd. (“XJZT” or the “Company”) to complete its debut offshore bond issuance of 3-year 7.000% coupon USD380 million Senior Fixed-rate Notes on 30 May, 2019 (the “Issuance”).

The Company is the first enterprise in Xinjiang publishing international ratings from S&P and Fitch simultaneously and the first State-Owned Enterprise in Xinjiang publishing rating from S&P, which are one of the highest among ratings of Xinjiang SOEs. CICC assisted the Company to achieve breakthroughs in both size and cost perspective. The Issuance is the largest offshore bond, and has the lowest yield in offshore bonds issued by SOEs in autonomous region level. The Issuance, as a milestone of XJZT, allows the Company to develop a new financing channel in international capital markets.

Established in July 2012, the XJZT is wholly owned by Xinjiang State-owned Assets Supervision and Administration Commission. By the end of 2018, the Company has owned total assets RMB93.06 billion, net assets RMB23.87 billion and operating income RMB100.46 billion. As the largest SOE in Xinjiang in terms of both assets and revenue, XJZT is the key platform of the government to promote industry consolidation and development, improve the operating efficiency of State-Owned assets, and optimize capital allocation. The Company also actively involves in the "Road and Belt" initiatives given its geographic advantage.

CICC arranged a non-deal roadshow covering Hong Kong and Singapore investors for the Company before the issuance, during which the Company fully displayed its credit highlights to international investors and had a deep understanding on feedbacks of them. Meanwhile, CICC continuously assisted the Company to accumulate high-quality anchor orders before book opening, laying a solid foundation for the Issuance. The Company captured favorable timing of market recovery for the Issuance. On the basis of high-quality anchor orders, CICC seized the optimal market window for bookbuilding and pricing, attracted orders from famous international institutional investors and achieved successfully pricing of the deal.

As sole Rating Advisor and lead Global Coordinator, CICC assisted the Company comprehensively present its credit highlights to achieve two international issuer ratings concurrently, and efficiently completed execution process including regulatory approval, due diligence, documentation, roadshow logistics, marketing and distribution, settlement and etc., which got fully recognized by the Company. The Issuance further solidified the leading position of CICC in the international debt capital markets.