CICC Assists Alibaba Group Holding Limited in Listing on the Main Board of HKEx

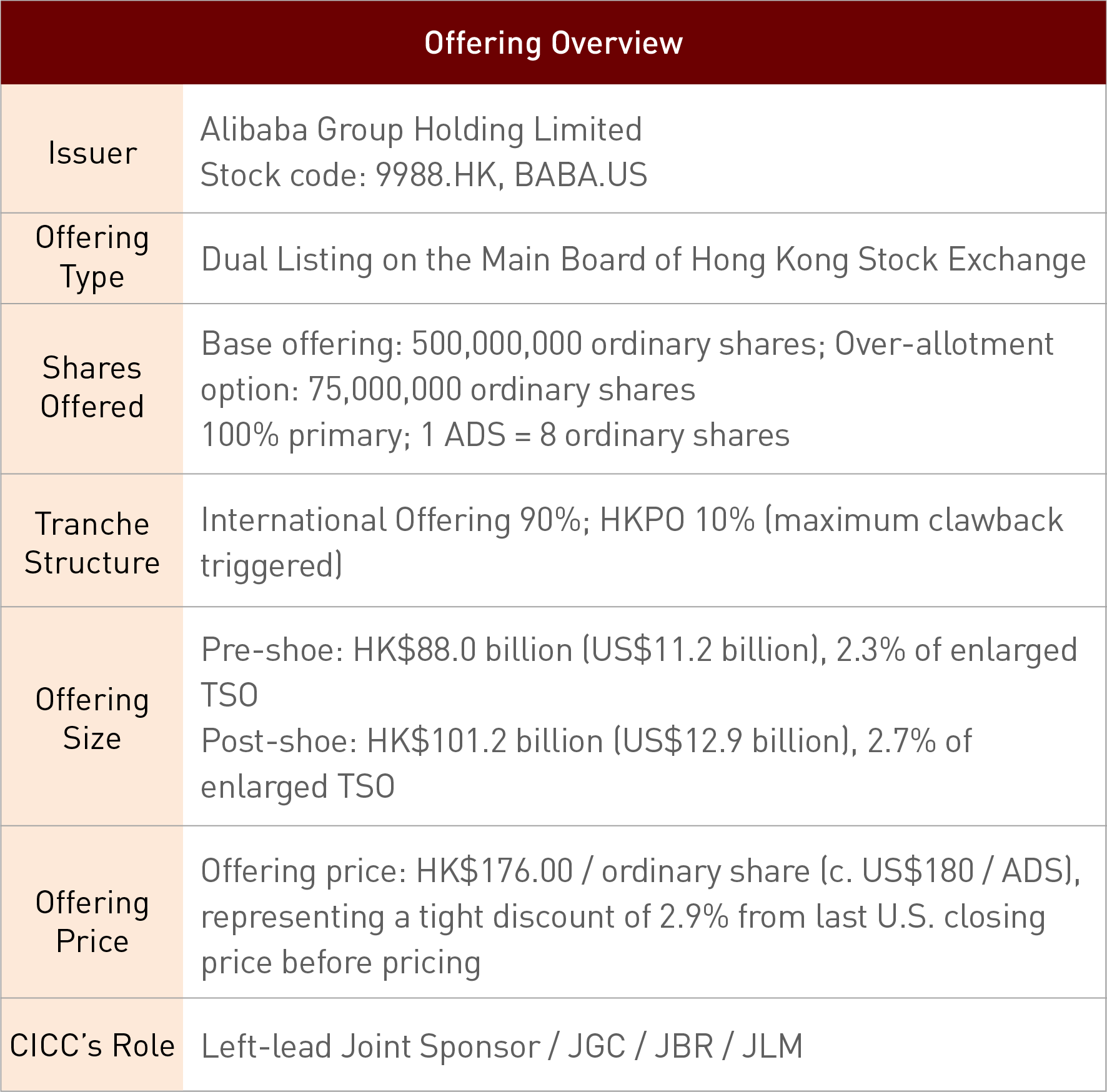

Alibaba Group Holding Limited (“Alibaba” or “Company”, BABA.US/9988.HK) has successfully completed its dual listing on the main board of HKEx on Nov 26th, 2019. The offering size is US$12.9 billion (assuming full exercise of over-allotment option). CICC acted as the left-lead Joint Sponsor, Joint Global Coordinator, Joint Bookrunner, and Joint Lead Manager.

This offering is the largest equity offering globally in 2019 YTD, the largest equity offering in Hong Kong and the largest Hong Kong public offering since 2011 by dollar amount, as well as the largest TMT equity offering in Hong Kong of all time. In addition, this transaction is the first secondary listing after the introduction of Listing Rule Chapter 19C and pioneered a fully paperless public offering in Hong Kong.

Alibaba is a world's leading technology company and the largest Chinese company worldwide by market capitalization. After 20 years of development, Alibaba has transformed from an e-commerce company to the basic infrastructure for the digital economy with an ecosystem that encompasses digital commerce, financial technology, intelligent logistics, cloud computing and big data.

Alibaba was listed on NYSE in 2014 and made the largest IPO of all time back then. In the last 5 years, its revenue grew by over 600%, outpacing other global technology peers, while its market cap went from US$170 billion at U.S. IPO to nearly US$500 billion. Alibaba aspires to be a good company that will last for 102 years, and has set its vision for 2036: to be serving 2 billion global consumers, empowering 10 million profitable businesses and to have created 100 million jobs.

As the left-lead Joint Sponsor and JGC of this offering, CICC led the overall marketing workstream, contributed multiple exclusive orders, and laid an important foundation for the eventual coverage of this offering. In particular, CICC introduced over US$10 billion demand from high-profile Chinese investors including long only institutions such as top-tier Chinese SWFs, national institutions and insurance companies, and Asia-pacific area / TMT sector focused funds. CICC successfully assisted Company in fulfilling its Hong Kong listing goal of accessing the incremental demand from Asia market, and further expanding / diversifying its shareholders base.

As a public company in the U.S. with enormous market and media attention, confidentiality is the key to the transaction from the kick-off to the time of publication. CICC led execution throughout the project proactively and efficiently, delivering satisfactory results and ensuring a smooth progression.

The transaction is the first ever secondary listing under Listing Rule Chapter 19C. CICC assisted Company in multiple rounds of communications with HKEx and SFC, minimized incremental disclosure and corporate governance disruption to Company, and passed Listing Committee Hearing efficiently. This transaction also pioneered a fully paperless public offering in Hong Kong, with no printed prospectuses and application forms offline. As the left-lead Joint Sponsor, CICC created detailed execution plan through in-depth discussion with HKEx/CCASS, SFC, eIPO service provider, receiving bank etc., to ensure a seamless subscription experience for the retail investors.

With its rich experience in project execution and strong edge on comprehensive service, successfully assisting Alibaba in listing in Hong Kong, CICC has won high praise and extensive recognition from the client in this deal. It is an classic case of CICC's long-term international professional service to domestic large-scale and high-quality enterprises.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.