CICC Assists CCB in Issuing USD 2bn Offshore Tier 2 Bond

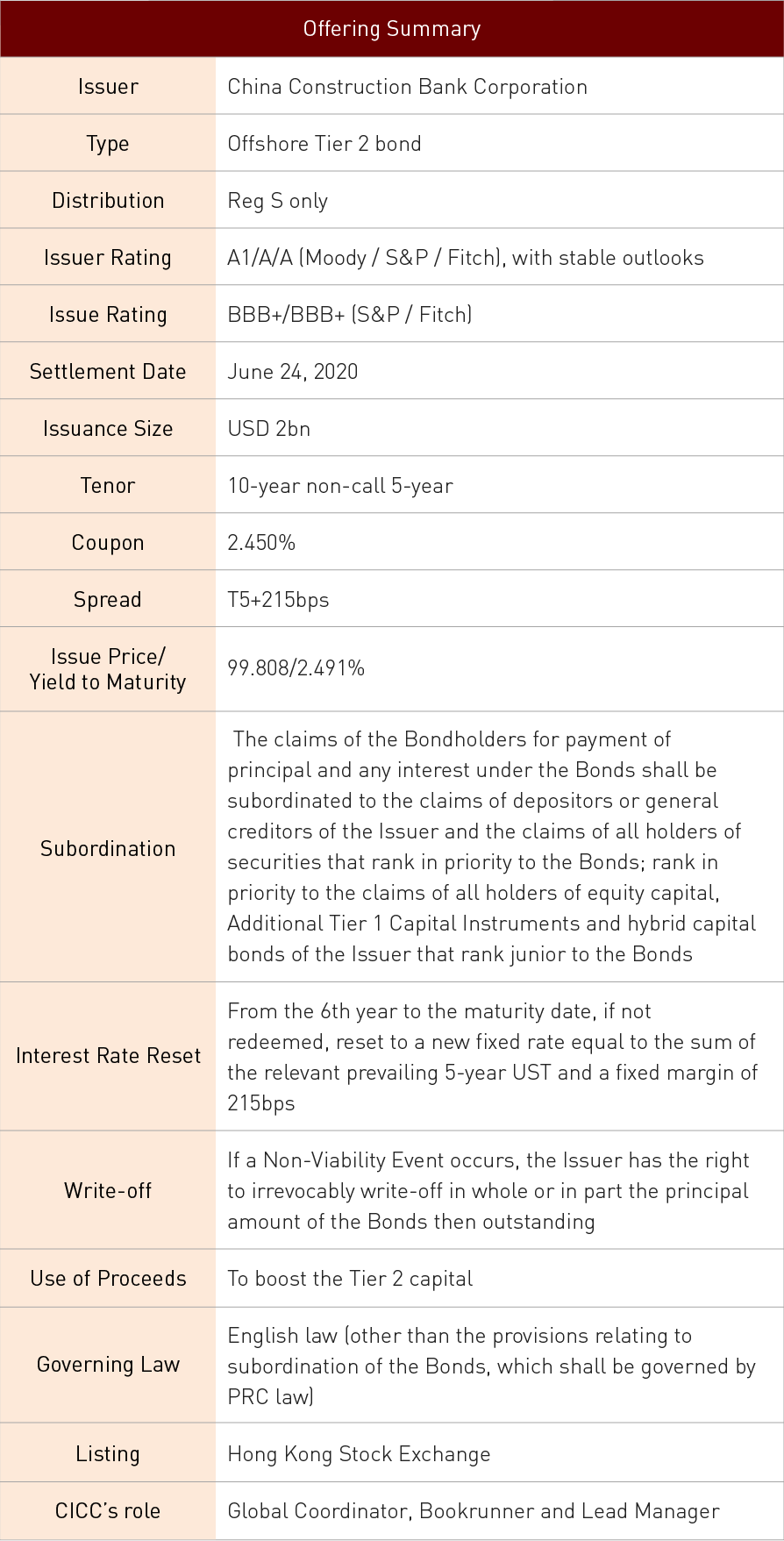

On June 17, 2020, CICC, acting as the Global Coordinator, assisted China Construction Bank Corporation (“the Issuer” or “CCB”) to successfully complete its USD 2bn Tier 2 bond issuance at a coupon of 2.450% (“the issuance”). As the first US dollar bond transaction launched by a Chinese commercial bank since the global outbreak of the Covid-19 pandemic, this issuance has attracted great attention from the international capital market and received subscription from a number of diverse and high-quality investors. Many sovereign funds and large global institutional investors have subscribed, and the issuance marks the lowest yield among all global capital instruments.

CICC overall leads the execution work in the transaction and is exclusively responsible for the communication with regulators. With the outstanding execution abilities, CICC successfully assisted CCB to accurately grasp the optimal issuance window to launch the transaction when the market gradually stabilized after the pandemic, coupled with good liquidity and strong demand. CICC also accompanied CCB to launch roadshows via teleconferences with nearly 150 institutional investors from 16 countries and regions, fully demonstrating CCB's outstanding credit highlights and the issuance was highly recognized by foreign investors.

On the pricing day, launched with an initial price guidance of T5+250bps area, the bond offering attracted a great number of sovereign funds, high-quality large international institutions to subscribe. Based on a strong order book, the issuance’s final price significantly narrowed by 35bps. The peak of the order book exceeded USD 6.4bn, with a 3.2x over-subscription. This deal is a landmark transaction in recent Asian bond market in terms of the issuance size, pricing level and investor diversification.

Since 2005, CICC has been deeply involved in multiple major projects of CCB in capital markets, including restructuring, H-share IPO, A-share IPO, ABS, offshore senior USD bonds, onshore and offshore Tier 2 capital instrument and offshore green bonds. This transaction is the second time CICC assisted CCB to successfully complete offshore Tier 2 bond issuance after the previous issuance in 2019, consolidating the strategic cooperation between the two parties.