CICC Assists Genetron Holdings Limited listed on NASDAQ

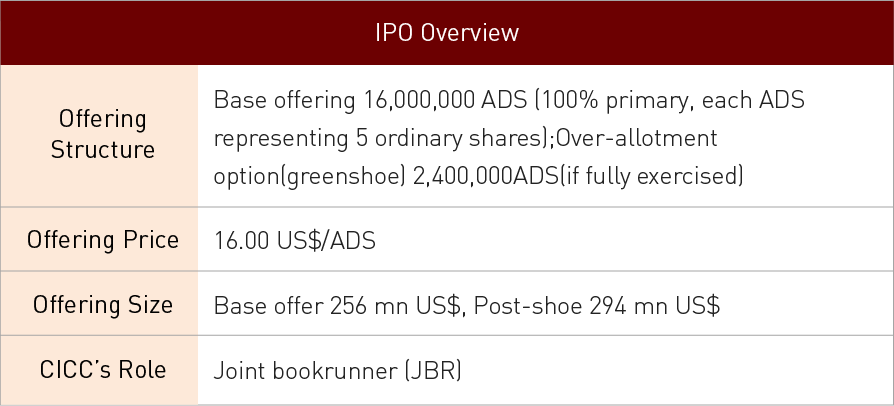

On June 19, 2020, Genetron Holdings Limited (“the Company” or “Genetron”, GTH.NASDAQ) has been officially listed on NASDAQ, raising approximately US$256 million (before greenshoe) / $294 million (after greenshoe), making it the largest IPO offering globally in the field of precision oncology . CICC acts as the joint bookrunner (JBR) for this project.

Genetron is a leading precision oncology platform company in China, focusing on cancer molecular profiling and harnesses advanced technologies in molecular biology and data science to improve cancer treatment. The Company has developed a comprehensive product and service portfolio covering the full-cycle of cancer care from early screening to diagnosis and treatment, and continuous monitoring. Genetron’s headquarter was established in Beijing, also with research centres and clinical laboratories located in Shanghai, Hangzhou, Chongqing, the United States and etc.

As an industry leader in precision oncology in China, Genetron offers comprehensive diagnosis and monitoring services for the full-cycle of cancer care through both LDT services and IVD products, covering eight categories of the top ten cancer types in China. According to Frost & Sullivan, the Company is a leading NGS-based cancer molecular diagnosis player by revenue in China with No. 3 market position and 11.6% market shares in 2019, measured by NGS-based LDT revenue in 2019. The Company is also No. 1 in the field of both CNS cancer and digestive system cancer, and No. 3 in lung cancer, accounting for approximately 58.3%, 14.8% and 9.2% of market shares respectively. In addition, Genetron is No. 1 among NGS-based cancer diagnosis and monitoring companies in China, in terms of the number of National Medical Products Administration (“NMPA”) approved IVD products. Moreover, the Company provides a high-quality, end-to-end comprehensive genomic profiling solution for global biopharmaceutical companies to advance its research and drug development.

CICC has accompanied the development of the Company since 2018 and assisted the company in formulating diversified capital operation plan. Based on the fully exploration of the listing path of NGS technology companies, the most suitable solution is recommended to the Company, which has been highly recognized by the management team as well as shareholders.

Under the environment of global outbreak of COVID-19 and global political and economic instability, the IPO market environment is extremely volatile and the issuance window is fleeting. CICC has arranged multiple rounds of conferences with investors to test the water in the early stage and communicated closely with the core investment institutions of the market. At the same time, based on the precise research and judgment of the macro economy and the timely grasp of investor sentiment, CICC accurately recommended the issuance window and finally successfully completed the issuance.

Through arranging multiple rounds of high-quality investor meetings and providing professional analysis delivered by research analysts, CICC helped the Company successfully implement multiple high-quality investor orders before official bookkeeping, which obtained high recognition from the management. Ultimately CICC secured significant Asian investor demand for the Company, which enabled the issuer to upsize the offering (from 163 mn US$ to 256 mn US$ pre-shoe).

As a leading investment bank with “China Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.