CICC Assists Jiumaojiu International Holdings in Successfully Completing Follow-on Placing as Placing Agent

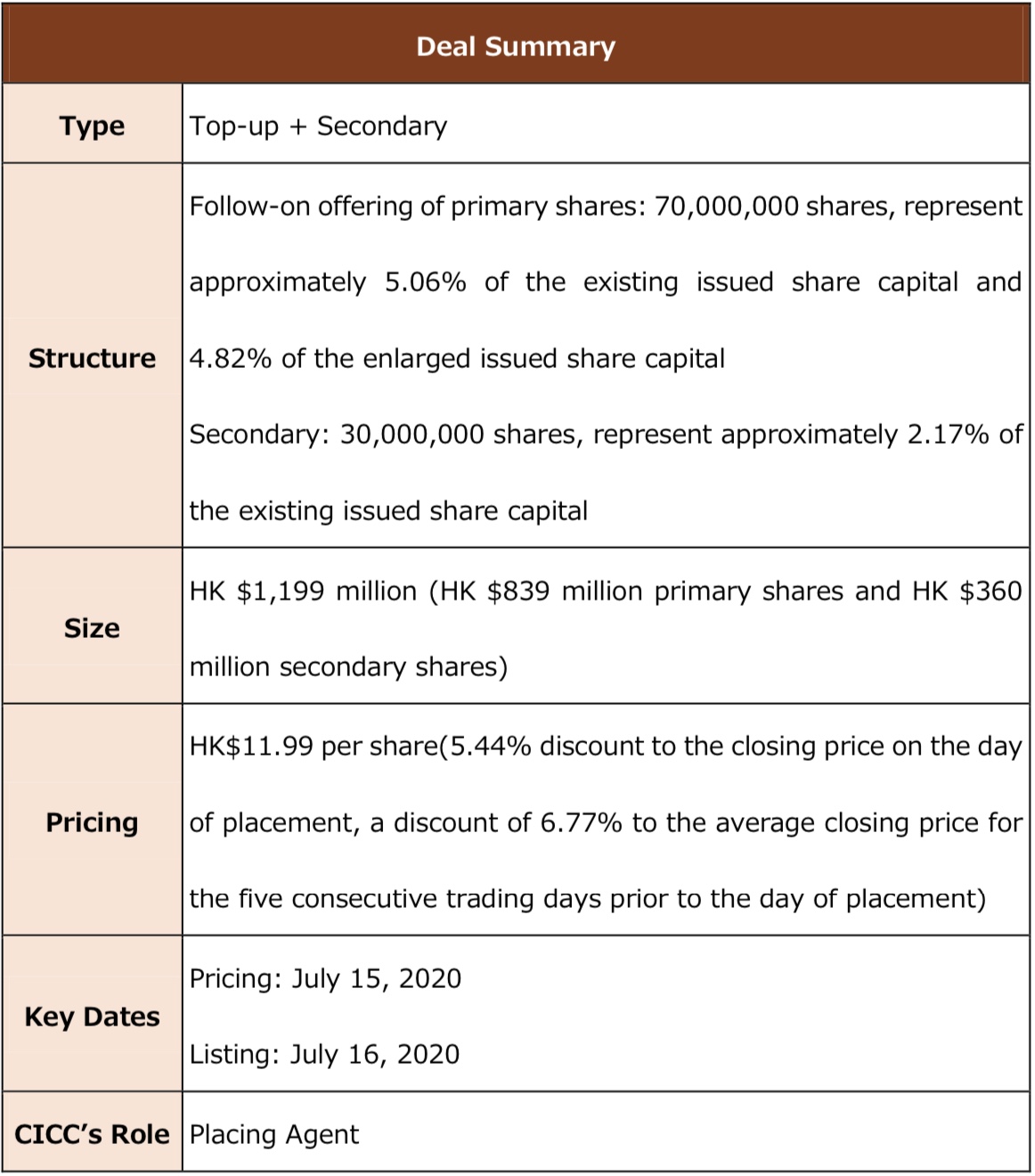

On July 16, 2020, CICC, as the placing agent, assisted Jiumaojiu International Holdings (the Company, 9922.HK) to complete Top-Up Placing of Existing Shares and Sale of Sale Shares By Selling Shareholders, with a price of HK $11.99 and offering size of HK $1,199 million.

Jiumaojiu International Holdings is a leading Chinese cuisine restaurant brand manager and operator in China. According to Frost & Sullivan, the company ranked third among all Chinese fast fashion restaurants in China and first among all Chinese fast fashion restaurants in Southern China. The company’s two major brands, Jiu Mao Jiu ranked second among all northwestern Chinese cuisine restaurants in China, and Tai Er ranked first among all Chinese sauerkraut fish restaurants in China, both in terms of revenue in 2018. As of Dec 30th, 2019, the company operated 292 restaurants and managed 44 franchised restaurants, covering 40 cities in 16 provinces and four municipalities in the PRC.

In pursuit of philosophy of serving delicacies at affordable prices, the company is fully devoted to providing marvelous dining experience to customers through exquisite dishes, high-quality services and unique dining ambiance. Innovation has been deeply rooted in corporate culture. The company currently manages and operates five self-developed distinctive brands.

CICC took the lead in the overall implementation of this placement and maximized the interests of the company: In response to company’s special demand for concurrent issuance of primary and secondary shares, CICC based on its rich experience, assisted the company in designing issuance terms and recommended a compact issuance schedule to avoid uncontrollable risk of stock price volatility. Throughout the issuance process, CICC took control of the overall implementation progress and completed the placement successfully.

CICC introduced dozens of high quality investors and helped to achieve successful issuance featuring both price and volume: CICC collaborated firmwide resources and fully leveraged its extensive client network in the book building process, which helped to achieve multiple times of book coverage shortly after book building began. Grasping good booking momentum, CICC also helped the company achieve ideal pricing with expanded issuance scale. Meanwhile, CICC introduced a number of high-quality long-term investors for this placement, further optimizing the company's shareholder structure.

CICC accurately grasped the fleeting issuance window and helped the company complete the issuance successfully: CICC closely followed up with industry trends and the company’s stock price. Under the great volatility of stock price in consumer and catering sectors of HK stock market, CICC accurately grasped the short-term favorable window, leading to a successful issuance result.

CICC has provided a full spectrum of services for Jiumaojiu from its HK listing to this placement: CICC has provided full spectrum capital market services for Jiumaojiu, including assisting in its successful listing on HKEx, and taking the lead in this placement. The total deal value that CICC involved is nearly HK $4,000 million and the completion of this placement has further deepened the cooperation between Jiumaojiu and CICC.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.