CICC Assists Succeeder’s IPO on STAR Market of SSE

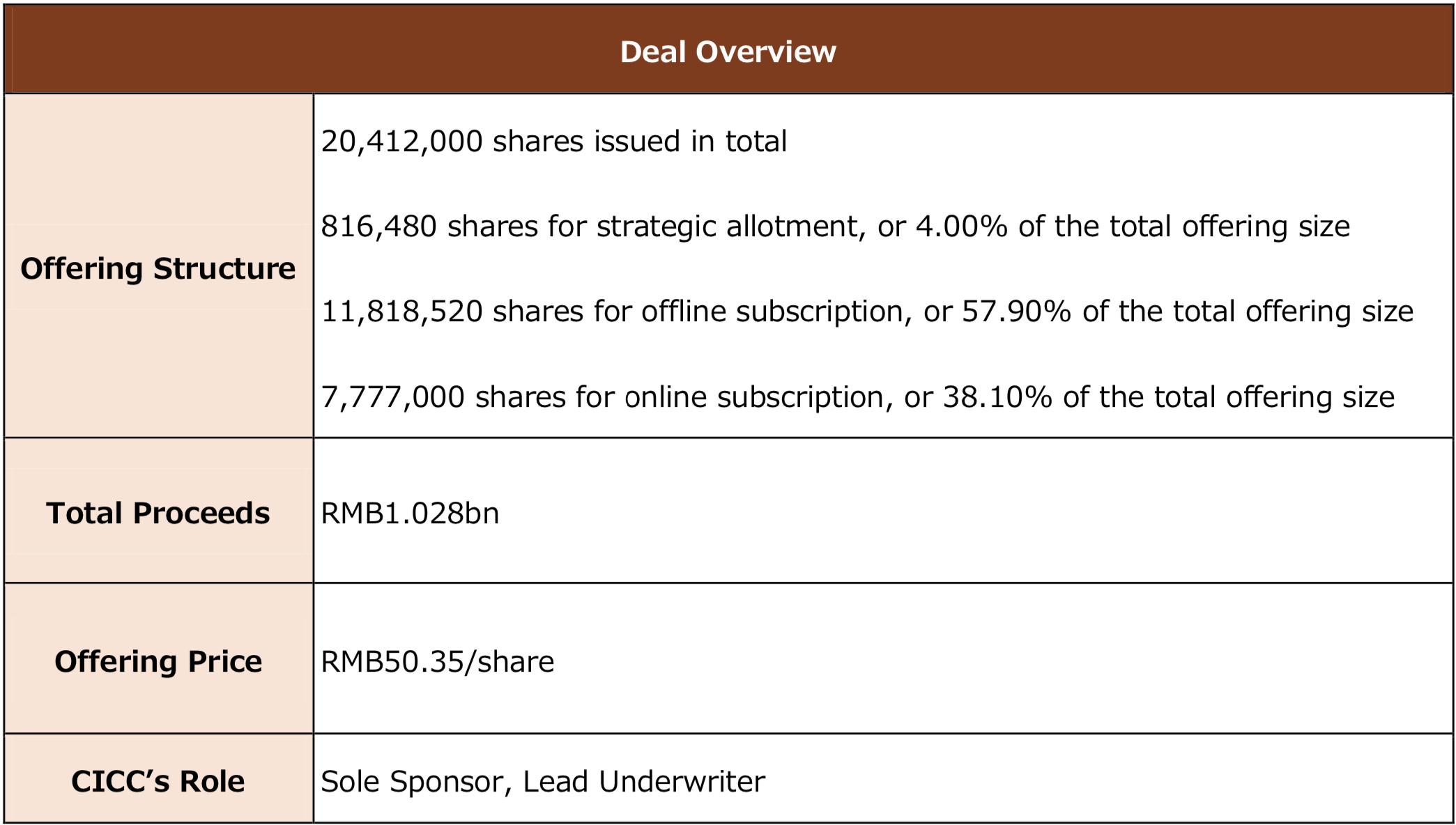

Beijing Succeeder Technology Inc. (“Succeeder” or the “Company”, stock code: 688338.SH) was successfully listed on the Shanghai Stock Exchange on August 6, 2020. CICC acted as Sole Sponsor and Lead Underwriter. 20.412 million shares were issued, accounting for 25% of enlarged capital, and RMB1.028bn was raised. The transaction marks a number of milestones: CICC for the first time solely sponsors an A-share issuer in in-vitro diagnosis (“IVD”); the largest IPO by proceeds among listed IVD firms on SSE STAR Market; and Succeeder is also the first A-share domestic brand focusing on coagulation and leading the sub-industries of thrombosis and hemostasis in IVD.

Succeeder’s shares are up 237.99% to RMB170.18 on their STAR Market debut, representing an increase of RMB119.83 over its RMB50.35 offering price and giving it a market value of RMB13.9 billion.

Since its establishment in 2003, Succeeder has been committed to the R&D, production and sales of testing devices, reagents and consumables in the sub-industries of thrombosis and hemostasis in IVD. It develops the first automated coagulation analyzer in China and participated in formulating reference materials of viscosity of non-Newtonian fluids, enjoying outstanding independent R&D and technological innovation capabilities. The Company, as a leading domestic manufacturer in thrombosis and hemostasis in IVD, provides medical institutions with automated coagulation analyzers, blood rheology analyzers, ESR analyzers and platelet aggregation analyzers, with supporting reagents and consumables.

Leveraging its strong R&D capability and leading position in the sector, Succeeder has developed a product system with independent core technology that integrates devices, reagents and consumables, focusing on coagulation testing and blood rheology testing, and continuously improving product professionalization, serialization and automation. At present, the Company’s self-developed IVD products for thrombus and hemostasis have obtained 21 medical device product registration certificates, including 14 for coagulation products, 5 for blood rheology products, 1 for ESR products, and 1 for platelet aggregation products. Its products cover the main testing items in thrombosis and hemostasis in IVD, and have entered more than 8,000 domestic medical institutions.

In the transaction, CICC was solely responsible for the listing application of the company, also approval and communication with regulatory agencies. With extensive deal experience and effective communication channels with regulatory agencies, CICC assisted Succeeder to become the first listed well-known coagulation-centered brand among A-share IVD firms, and contributed to the company’s important breakthrough in the capital market.

As Sole Sponsor and Lead Underwriter in this transaction, CICC actively mobilized various resources, accurately grasped the key review points, and fully tapped into the investment highlights and stories through long-term and in-depth analysis of the Company. In addition, we arranged multiple roadshows for the Company to fully demonstrate its value to investors, which was highly recognized by the market and led to investor quotations significantly better than other comparable deals recently, laying a solid foundation for the final pricing and the successful issuance.

As a leading investment bank with “China Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.