CICC Assists KE Holding Inc. to List on NYSE

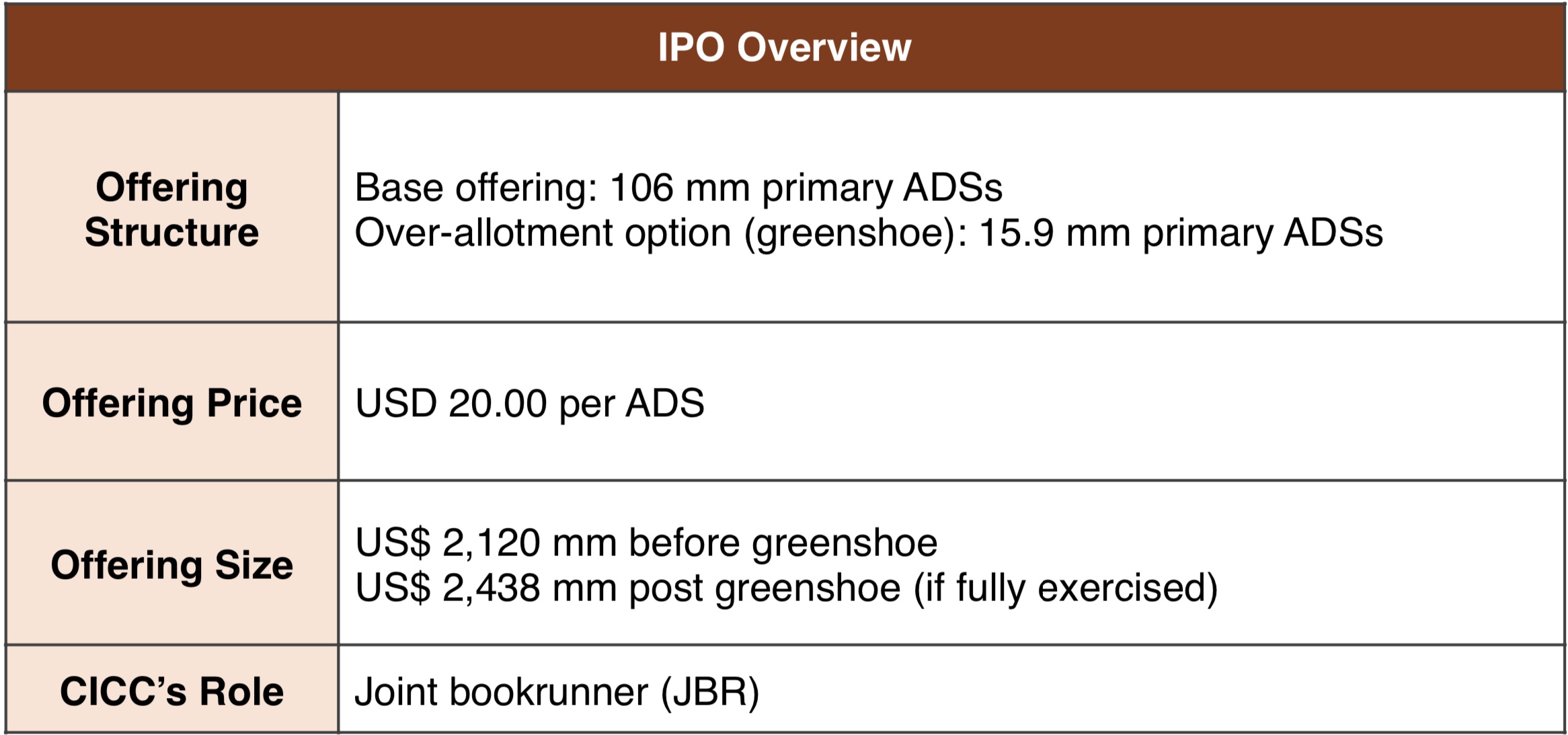

On August 13, 2020, KE Holding Inc. (“the Company” or “KE”, NYSE: BEKE) has been officially listed on NYSE, raising US$2.12 billion (before-greenshoe)/ US$2.438 billion (post-greenshoe, if fully exercised), making it the largest ever Prop-tech IPO globally, the largest U.S. IPO of a Chinese company since 2015 (post-greenshoe, if fully exercised), and the second largest U.S. IPO in 2020 YTD. CICC acts as a joint bookrunner (JBR) for this deal.

KE is a leading integrated online and offline platform for housing transactions and services in China, providing a full range of services from existing and new home sales to home rentals, home renovation, real estate financial solutions, and other services. The Company has more than 18 years of operating history since the inception of Lianjia by Mr. ZUO Hui in 2001. As of June 30, 2020, KE had 265 real estate brokerage brands, over 42,000 community-centric stores and over 456,000 agents on its platform in China. In 2019, KE generated a gross transaction value (GTV) of RMB2,128 billion on the platform, making it China’s largest housing transactions and services platform, and the second largest commerce platform across all industries, according to China Insights Consultancy.

KE has achieved outstanding financial growth. In 2018, 2019 and the first 6 months of 2020, the Company generated revenue of RMB28.65 billion, RMB46.01 billion and RMB27.26 billion, respectively, and adjusted net profit of RMB0.13 billion, RMB1.66 billion and RMB1.86 billion, respectively.

Facing various external uncertainties, CICC arranged multiple rounds of TTW conferences with investors in the early stage and communicated closely with the institutional opinion leaders of the market, helping the Company accurately grasp the market window and successfully completed the IPO.

In this offering, CICC uncovered global investors’ demands by leveraging its global sales network, maximized the efficiency of the roadshows by conducting them remotely, and helped the Company receive no price-limit orders from more than 30 leading global sovereign and top international long-only funds, achieving 100% conversion rate from one-on-one roadshow meetings. CICC introduced over 10x demand coverage for the Company, assisting the Company to price above the filed upper pricing range.

With in-depth understanding of the TMT and real estate industry in China, CICC fully tapped into the Company's investment highlights. Two teams of research analysts from CICC conducted nearly 100 intensive PDIEs to communicate with the investors, winning enthusiastic feedbacks and establishing strong bookkeeping momentum. CICC helped the Company achieve an ideal valuation.

With the structural opportunities underway brought about by the transformation of the traditional economy, KE’s U.S. IPO is another Prop-tech IPO deal that CICC completed. CICC continues to serve the growth of innovative enterprises that facilitate the transformation of traditional industries via technologies and the internet.

As a leading investment bank with “China Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless integration of onshore and offshore capabilities, to provide continuous supports to customers through introducing global investors, reaching international capital market, and promoting global business development.