CICC Assists JS Global in Completing Follow-on Placing

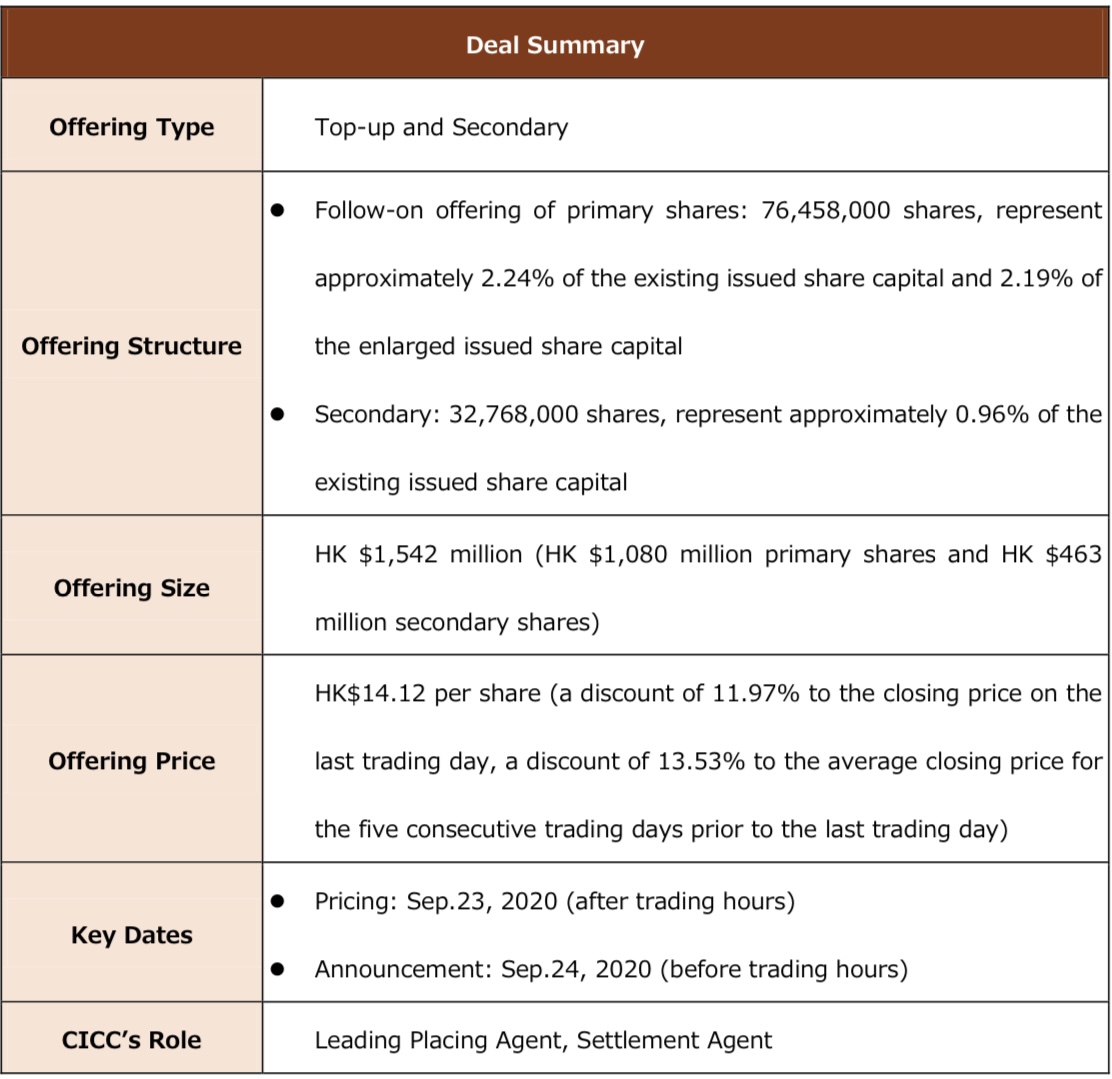

On Sep.24, JS Global Lifestyle Company Limited (“JS Global” or “the Company”, 1691.HK) completed the Top-Up placement. The placement consists of a follow-on offering of 76,458,000 primary shares and selling of 32,768,000 shares by existing shareholder, with an offering price at HK $14.12 and total placement size of HK $1,542 million. CICC acted as the Leading Placing Agent and Settlement Agent in this placement.

JS Global

JS Global is a global leader in high-quality, innovative small household appliances, with the controlling shares in Joyoung (002242.SZ) and 100% shares of SharkNinja, a well-known American housewares company. With the trusted market-leading brands, Joyoung, Shark and Ninja, the Company has a diverse product portfolio of household cleaning appliances and kitchen appliances.

The Company is built on its strong product innovation and design capability powered by a global research and development platform, marketing strengths driving high brand engagement, and an omni-channel distribution coverage with high penetration. The Company ranked 6th globally by market share in 2018, 3rd in China, and 2nd in the US. Meanwhile, the Company maintains a leading market share in several separate product segments.

CICC took the lead in the overall implementation of this placement and maximized the interests of the Company. As the leading placing agent and settlement agent, in response to the Company’s demand for concurrent issuance of primary and secondary shares, CICC based on its rich experience, assisted the Company in designing issuance terms and recommended a compact issuance schedule to avoid uncontrollable risk of stock price volatility. Throughout the issuance process, CICC took control of the overall implementation progress and completed the placement successfully, maximizing the Company's interests.

CICC introduced dozens of high quality investors and helped the Company achieve successful issuance, featuring both price and volume. CICC mobilized various departments' resources and fully leveraged its extensive client network in the book building process, which helped the Company achieve multiple times of book coverage shortly after book-building began. Grasping good booking momentum, CICC also helped the Company achieve ideal pricing with expanded issuance scale. Meanwhile, CICC introduced a number of high-quality long-term investors for this placement, further optimizing the Company's shareholder structure.

CICC accurately grasped the fleeting issuance window. CICC closely followed up with industry trends and the Company’s stock price. Under the volatility of HK capital market and the Company’s stock price, CICC accurately grasped the short-term window, leading to a successful issuance result.

CICC provides a full spectrum of services for JS Global from its HK listing to this placement. CICC has provided full spectrum capital market services for JS Global, including assisting in its successful listing on HKEx, and taking the lead in this placement. The completion of this placement has further deepened the cooperation between JS Global and CICC.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.