CICC Assists Ming Yuan Cloud in Listing on the Main Board of HKEx

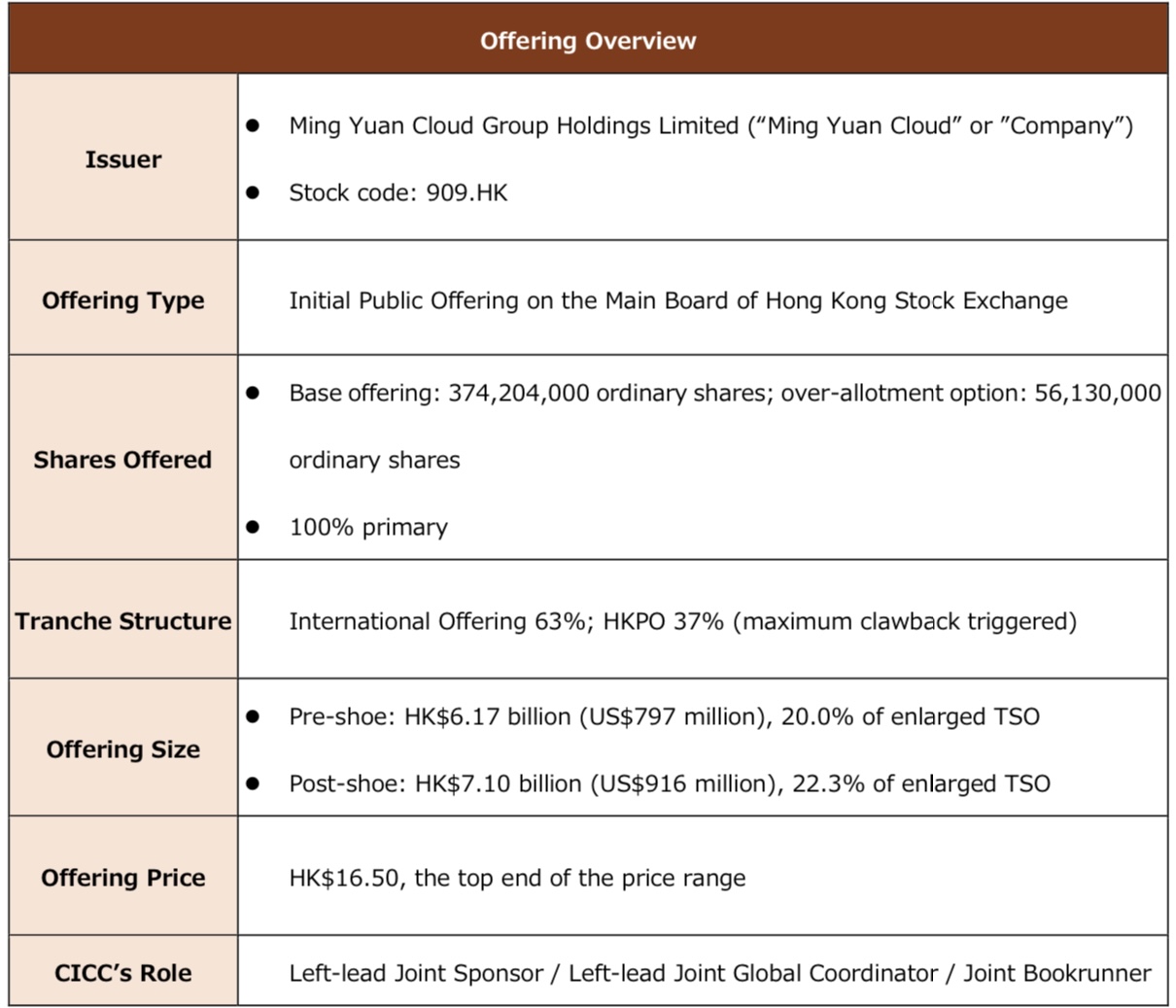

Ming Yuan Cloud Group Holdings Limited (“Ming Yuan Cloud” or “the Company”, 909.HK) has successfully completed its initial public offering on the main board of HKEx on Sep 25, 2020. The offering size is US$916 million (assuming full exercise of over-allotment option). CICC acted as the Left-lead Joint Sponsor, Left-lead Joint Global Coordinator and Joint Bookrunner.

This is the largest ever Chinese software & cloud service company IPO globally in terms of offering size, and Ming Yuan Cloud has also become the first vertical SaaS stock listed on the HKEx. As the 2nd most subscribed stock in the HK market in 2020, Ming Yuan Cloud’s HK Public Offering has been oversubscribed for over 644 times (before clawback), with a total subscription amount of over HK$400 bn from retail investors.

Ming Yuan Cloud is dedicated to providing a comprehensive suite of industry-specific ERP solutions and SaaS products for property developers and other real estate industry participants to manage a wide range of business operations, improving their management efficiencies and business collaborations. In 2019, Ming Yuan Cloud directly and indirectly served 3,000 property developers. Among the Top 100 property developers in 2019 according to the CRIC, Ming Yuan Cloud directly and indirectly served 99. Ming Yuan Cloud’s SaaS products, developed targeting the important business scenarios in the real estate value chain, consist of CRM Cloud (云客), Construction Cloud (云链), Procurement Cloud (云采购) and Asset Management Cloud (云空间), serving the demands for sales office management, construction site management, online bid and tender, property asset management and other related operations. Ming Yuan Cloud’s ERP solutions allow property developers to effectively integrate and manage enterprise resources and optimize core business functions including procurement, cost management, project planning, budgeting, and sales & marketing.

Acting as the Left-lead Joint Sponsor, Left-lead JGC and the Joint Bookrunner of this offering, CICC led the overall project coordination and marketing workstream, and successfully assisted Company in accomplishing its goal of HK listing.

Since the end of 2018 when CICC formulated the restructuring plan for the Company for its Hong Kong IPO, CICC acted as the financial advisor and IPO sponsor of Ming Yuan Cloud, offering the Company full support and an optimal IPO plan. During the worst period of COVID-19, CICC led in all major workstreams with high quality and adaptability, and proactively adjusted IPO plan in time to assist the Company in achieving key execution milestones and efficiently go through the vetting process.

The offering received extensive attention from global investors. CICC assisted the Company in securing multi-times covered cornerstone and anchor orders in advance, laying a solid foundation for the high-end pricing.

With its in-depth experience in the capital market and a full spectrum of services, CICC earned great recognition and strong trust from Ming Yuan Cloud by assisting the Company in its listing. It established another classic case of CICC serving large-scale and high-quality Chinese enterprises.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide customized and top-notch capital market support to our customers in terms of introduction of global investors, reaching international capital market and promoting global business development.