CICC Assists Yihai Kerry Arawana Holdings Co., Ltd. in Listing on SZSE ChiNext

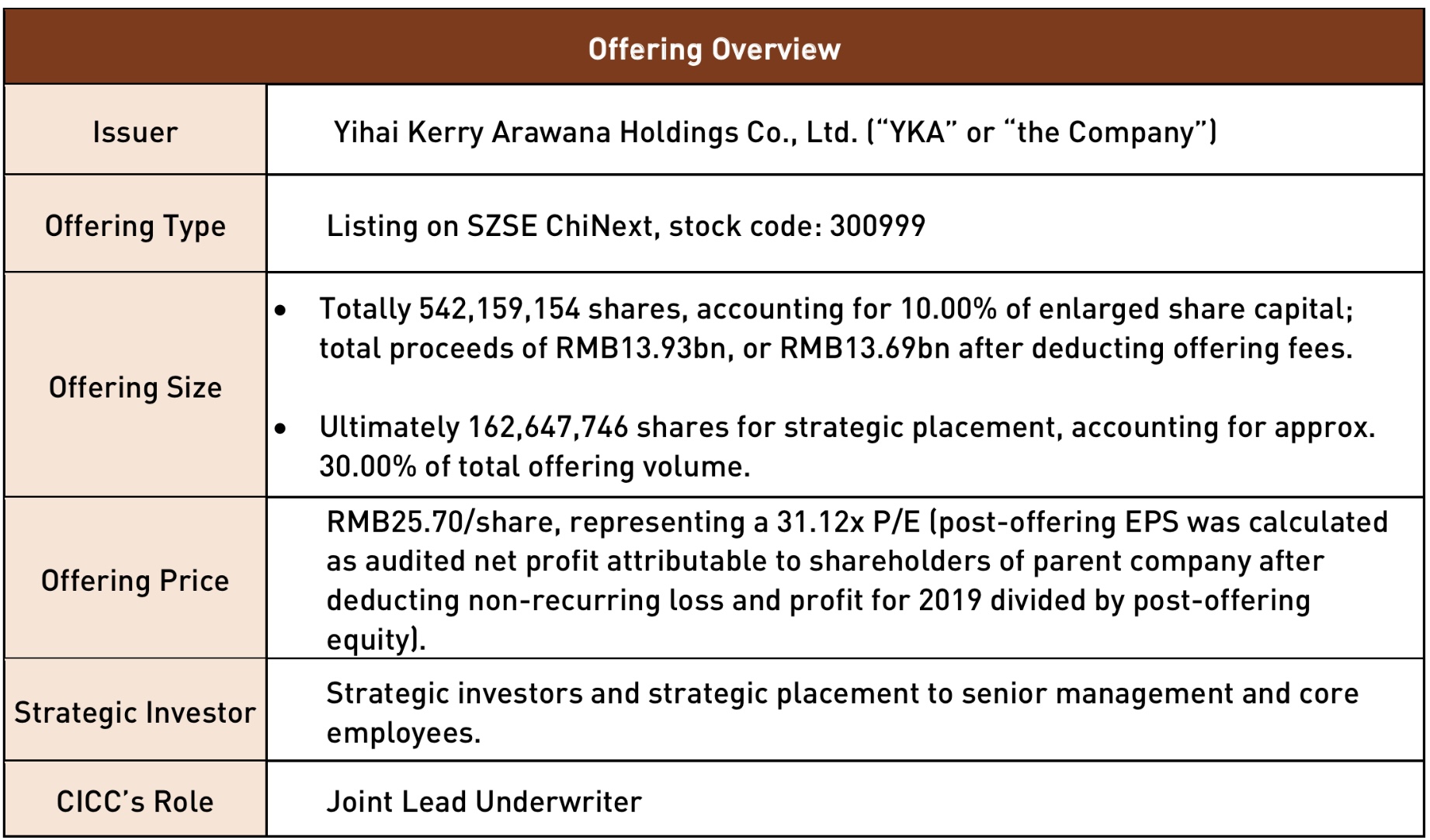

Yihai Kerry Arawana Holdings Co., Ltd. (“YKA” or “the Company”, 300999.SZ) has successfully completed its RMB13.93bn IPO on the ChiNext of Shenzhen Stock Exchange on October 15, 2020. CICC acted as the Joint Lead Underwriter in the transaction.

The offering is the first A-share spin-off IPO of a subsidiary of a SGX-listed company(Wilmar International), as well as the largest IPO by offering size on the ChiNext, and the first ChiNext IPO to involve external strategic investors.

YKA is one of the largest agricultural product and food processing companies in China. The Company’s core products are kitchen food, which range from cooking oil to rice, flour and condiments, occupying an unchallenged leading market share in the consumer goods sector. With multiple well-known brands such as “Arawana”, “Olivoila”, “Orchid”, “Wonder Farm” and “Neptune”, YKA not only satisfies families’ cooking needs with small-package retail products, but also provides medium-package products for catering clients and raw materials for food processing enterprises.

The Company occupies approx. 40% of the small-package cooking oil market, approx. 30% of the packaged flour market (by modern trade), and approx. 20% of the packaged rice market (by modern trade). From 2017 to 2019, YKA’s revenue from kitchen food products rose from RMB90.3bn to RMB108.8bn, with a CAGR of 9.8%. In 1H2020, the Company’s revenue increased steadily to RMB86.973bn, and its net profit achieved an impressive yoy growth.

As the Joint Lead Underwriter, CICC leveraged its profound knowledge of ChiNext’s registration-based reform and extensive IPO execution experience to facilitate YKA’s regulatory review for registration-based offering. Through a thorough analysis of the Company and with its understanding of the issuer’s industry, CICC dug into YKA’s business model and helped the Company fully explore investment highlights, earning a high market recognition for its offering.

The offering attracted wide attention during the marketing stage. Engaging in the strategic placement, CICC locked premium strategic partners and long-only investment institutions, and assisted the Company to introduce quality strategic investors, laying a solid foundation for the market-oriented pricing and the successful offering. Additionally, CICC assisted the Company’s senior management and core employees to establish a special asset management plan to participate in the strategic placement.

CICC helped YKA to complete the A-share IPO on ChiNext with its rich transaction experience and full-spectrum service capabilities. This successful cooperation has further cemented CICC’s reputation in serving the top players in the consumer goods industry, consolidating its leading position in investment banking services for the consumer goods sector. This successful offering has become another classic case of CICC’s service for mega enterprises and multinationals.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide customized and top-notch capital market support to our customers in terms of introduction of global investors, reaching international capital market and promoting global business development.