CICC Assists Neusoft Education Technology in Listing on HKEx

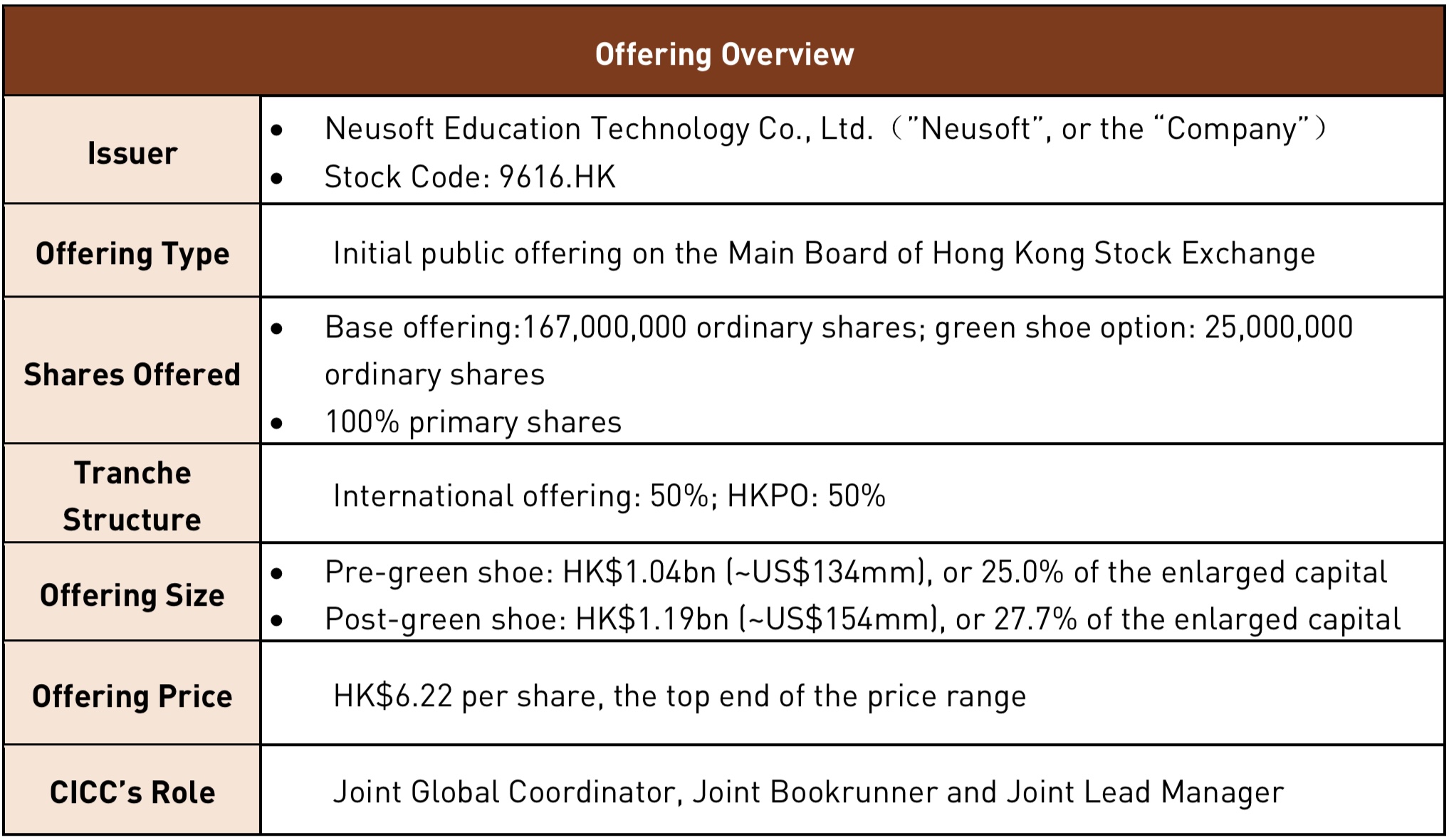

On September 29, 2020, Neusoft Education Technology Co., Ltd. (“Neusoft” or the “Company”, 9616.HK) was successfully listed on the Hong Kong Stock Exchange (“HKEx”), with an offering size of US$154mm (assuming full exercise of green shoe option). CICC acted as Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager in this transaction.

This is the first-ever private IT higher education IPO in HK capital market and one of the 3 largest private higher education IPOs in HK capital market in the past 3 years. The offering was well received by investors, with the HKPO tranche oversubscribed by over 300x and pricing at the higher end of the price range.

Neuedu is a leading private provider of IT higher education services in China and focuses on cultivating IT professionals to meet the rapidly-increasing demand for talents in China’s software and IT service industry. The Company has established three IT application-oriented universities in Dalian, Foshan and Chengdu. Based on this, the Company has integrated online and offline services, vigorously expanded its two strategic businesses of continuing education, educational resources and apprenticeship programme, and served the reform and development of more than 400 universities in China. The Company also set up subsidiaries in Shenyang, Dalian, Shanghai, Tianjin, Suzhou, Chengdu and Guangzhou, as well as 10 apprenticeship programme delivery centers in 8 provinces across the country. Nowadays it has become China's leading digital talent education service provider.

CICC continuously provided various capital operation services for many subsidiaries of Neusoft Corporation including Neuedu, and with quality comprehensive investment banking services and professional, diligent and unwavering spirit, won high recognition from the Company and Neusoft Corporation for our professional and efficient deal execution and teamwork.

Confronted with the severe challenges of the COVID-19 pandemic and the global market fluctuations, CICC overcame difficulties in marketing and assisted the Company to achieve a 300x oversubscription for the HKPO despite the adverse market conditions. This offering attracted the attention from numerous long-only funds and education-focused investors and boosted the market confidence which in return facilitated the successful offering.

As a leading Chinese investment bank that upholds the values of “Chinese Roots and International Reach” and “By the People and For the Nation”, CICC has always been providing high-quality value-added financial services to our clients. With extensive capital market experiences and the capability of seamlessly integrating domestic and overseas businesses, CICC will continue to provide our clients first-class financial services to support their strategic development goals.