CICC Assists Simcere Pharma in Listing on HKEx

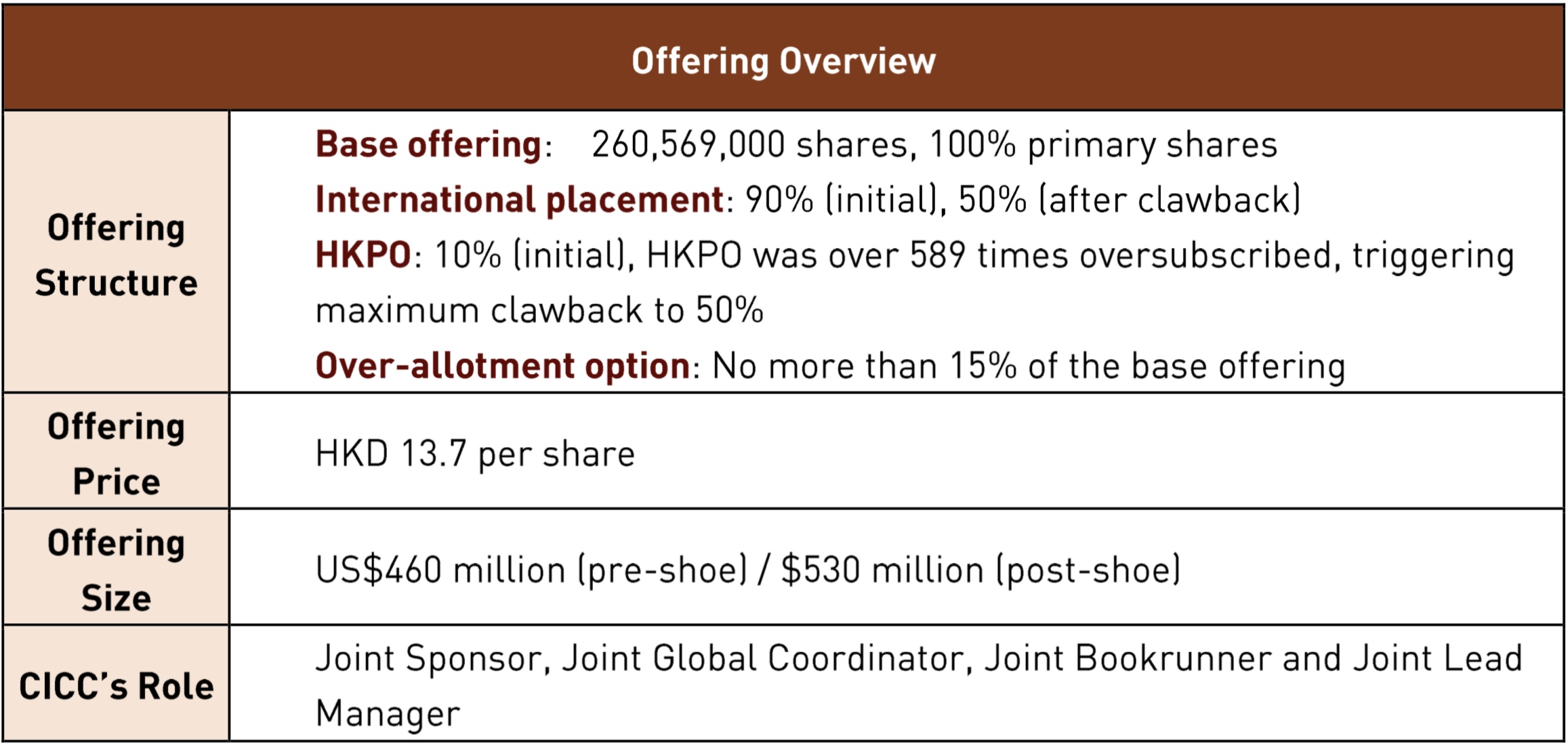

On October 27, 2020, Simcere Pharmaceutical Group Limited (“Simcere Pharma ” or “the Company”, 2096.HK) was officially listed on the HKEX mainboard, raising approximately US$460 million (pre-shoe) / $530 million (post-shoe). CICC acted as the Joint Sponsor, Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager on this transaction.

This is the IPO on HKEx with the highest ranking among “Top 100 Pharmaceutical Manufacturing Enterprises of China” in 2020. It is also the Top 3 IPO on HKEx of “Top 100 Pharmaceutical Manufacturing Enterprises of China” since 2017.

Simcere Pharma is a company engaged in the R&D, production and commercialization of pharmaceuticals and currently is primarily focused on generic pharmaceuticals. The company has a diversified product portfolio in its strategically focused therapeutic areas, including, (i) oncology (including cell therapy), (ii) central nervous system diseases and (iii) autoimmune diseases. According to Frost & Sullivan, together, these therapeutic areas accounted for 24.7% of the total PRC pharmaceutical market in terms of sales revenue of pharmaceuticals in 2019. Its diversified product portfolio centers around 10 major products (including seven generic pharmaceuticals, two category I innovative pharmaceuticals and one new formulation drug) with leading positions in their respective therapeutic segments and/or established track record.

The company was the first pharmaceutical company with both biologics and small molecule drugs in China listed on the NYSE at the time of listing in 2007, and subsequently privatized itself in 2013.

The company has been recognized as one of the “Top 10 Innovative Pharmaceutical Enterprises in China” from 2014 to 2019 and as one of the “Top 100 Pharmaceutical Manufacturing Enterprises of China” from 2009 to 2018. The revenue of 2019 is RMB5,036.7 million, and the profit is RMB1,003.6 million.

The offering was sought-after by a large number of investors, with the HKPO receiving over 589 times oversubscription, and the international placement receiving 23 times oversubscription.

Since 2015, CICC continuously serviced the Company with professional, diligent and unwavering spirit. CICC has won high recognition from the Company for its professional and efficient deal execution and teamwork.

CICC led and coordinated multiple execution work streams, completed the tasks efficiently despite the difficulties caused by COVID-19, and completed the IPO in only 8 months. In particular, CICC did the heavy lifting by leading business, legal and third party due diligence, critical to obtaining regulatory approval.

Despite the harsh and volatile market conditions under the backdrop of global COVID-19 outbreak, CICC mobilized various resources, and utilized deep understanding of the Company to secure multiple high quality cornerstone and anchor investors, critical to building market confidence and securing the high-end pricing, which was highly recognized by the Company.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide customized and top-notch capital market support to our customers in terms of introduction of global investors, reaching international capital market and promoting global business development.