CICC Assists Pirelli in EUR500mm Offshore Convertible Bond Issuance

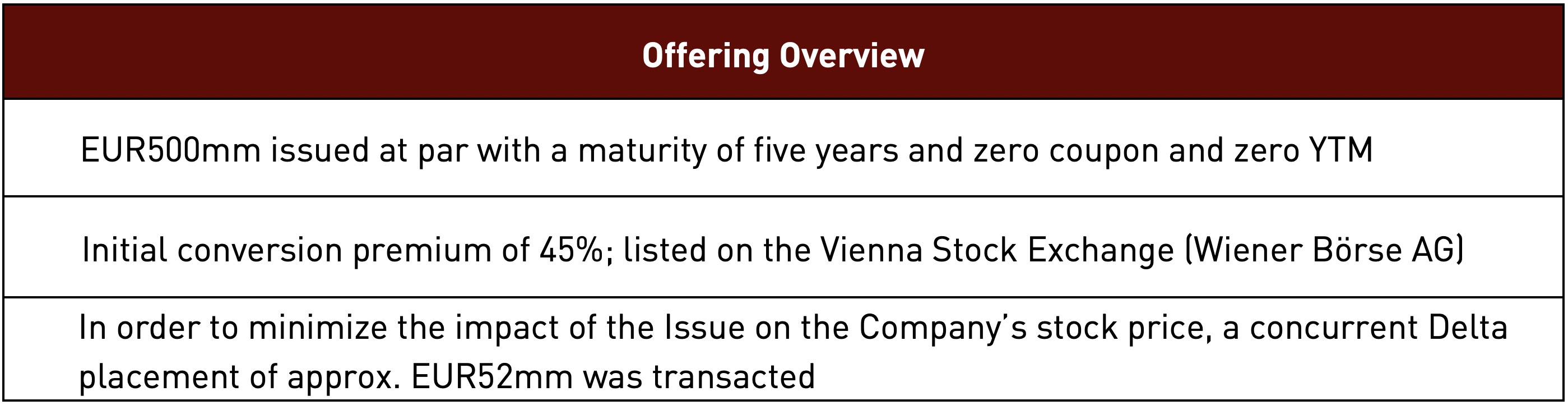

On December 15, 2020, Pirelli & C. S.p.A. (PIRC.MI, “Pirelli”, the “Issuer”, or the “Company”), listed on the Italian Stock Exchange in Milan (Borsa Italiana), priced its EUR500mm offshore convertible bond issue (the “Issue” or the “Project”). CICC acted as Joint Bookrunner in the Project.

The Issue marks Pirelli’s debut convertible bond offering since its re-listing in 2017. It is also the only Euro convertible bond issuance in the tire industry this year. The Project also marks a first for CICC, facilitating a European firm in convertible bond issuance as a Joint Bookrunner.

About Pirelli

Founded in Milan in 1872, Pirelli, after more than one century’s development, is now one of the world’s top tire manufacturers and suppliers, and leads the high-end tire market. The Company has approx. 31,500 employees worldwide, commercial presence in over 160 countries, and manufactures over 2,300 types of original equipment tires.

In 1908, Pirelli adopted the “Long P” logo, which came to identify the company worldwide. Since 2011, Pirelli has remained the sole tire supplier for the FIA Formula One World Championship. It is also a long-term sponsor for world-class influential sports events such as the Italian Series A. Pirelli is widely recognized as a premium brand.

In the Project, CICC assisted the Company in completing issuance preparations in a compressed timeline amid a highly volatile market. Thanks to the sound marketing strategy, the Issue was highly sought after by investors during launch, attracting subscription from more than 100 high-caliber international institutions. In the end, the book was multiple times oversubscribed, and the initial conversion premium was priced on the high end of the marketing range.

In the context of the gradual easement of the global epidemic and the steady recovery of the economy, CICC facilitated the client to successfully close the pricing and issuance, earning high praise from the Issuer, and reflecting our outstanding execution and underwriting capabilities in offshore convertible bond issuance. The Project is another successful example of CICC serving multinational clients leveraging capital market expertise and global footprint.