CICC Assists Sino-Ocean Service in Listing on HKEX Main Board

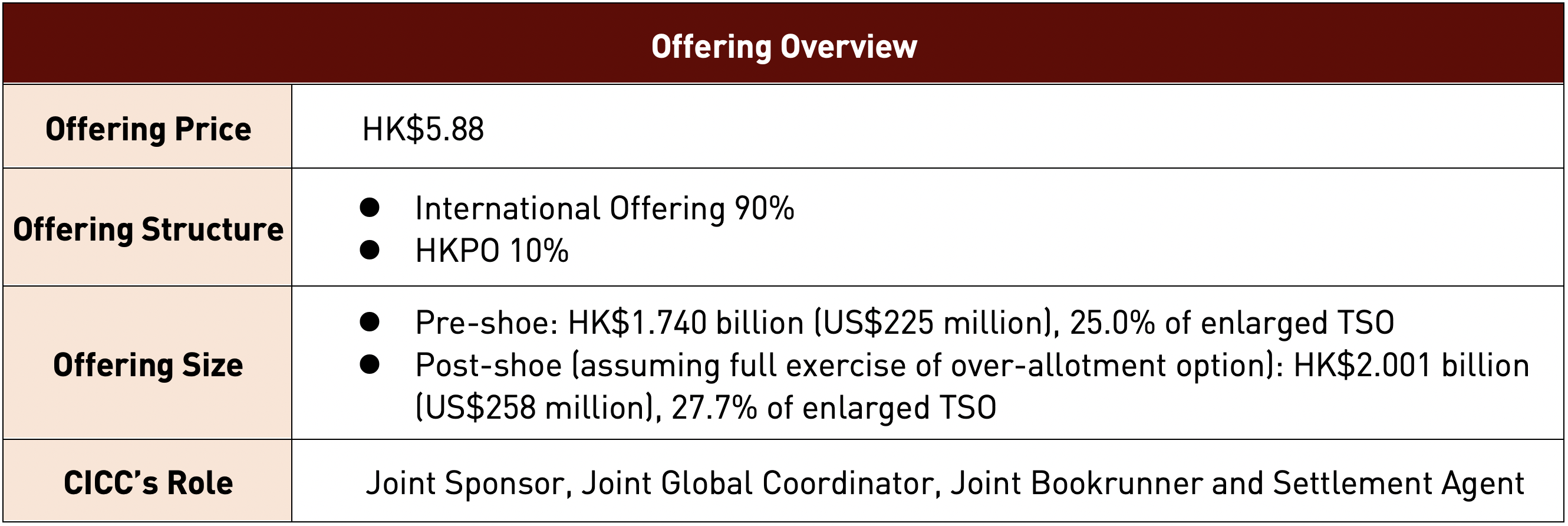

Sino-Ocean Service Holdings Limited (“Sino-Ocean Service” or “the Company”, 6677.HK) is successfully listed on the main board of Hong Kong Stock Exchange on December 17th, 2020. The offering size is US$258 million (assuming full exercise of over-allotment option). CICC acted as the Joint Sponsor, Joint Global Coordinator, Joint Bookrunner and Settlement Agent.

As a subsidiary of Sino-Ocean Group, Sino-Ocean Service is a comprehensive property management service provider with extensive geographic coverage in the PRC. Sino-Ocean Service has been providing property management services in China for more than 20 years with a focus on developed area. As of June 30, 2020, the Company's geographic coverage of GFA under management in first-tier and second-tier cities in China accounts for 90.8% of its total GFA under management. The Company's total contracted GFA reached 61.9 million sq.m., covering 54 cities across 24 provinces, municipalities and autonomous regions in China, and managed 210 properties in China with a total GFA under management of 42.3 million sq.m., including 155 residential communities and 55 non-residential properties.

Sino-Ocean Service has a strong presence in the Beijing-Tianjin-Hebei region and the Bohai Rim region, whose services include three main business lines, namely: property management services; value-added services to non-property owners; and community value-added services. Sino-Ocean Service focuses on mid-to-high-end properties, especially has a strong management capability in the field of high-end commercial properties. The Company has managed many landmark projects such as Chengdu Sino-Ocean Taikoo Li and Beijing Indigo, enjoying a wide reputation in the industry. According to China Index Academy, the Company ranked 13th and 11th among the Top 100 Property Management Companies in China in terms of overall strength and growth potential in 2019, respectively. At the same time, Sino-Ocean Service is recognized as one of the eight 2020 Excellent Property Management Companies for Commercial Property Management.

Sino-Ocean Service has achieved outstanding financial growth. In 2017, 2018, 2019 and the first half of 2020, the Company generated revenue of RMB1.21 billion, RMB1.61 billion, RMB1.83 billion and RMB0.90 billion, respectively, and net profit of RMB0.10 billion, RMB0.14 billion, RMB0.21 billion and RMB0.15 billion, respectively.

As the Joint Sponsor, CICC has been deeply involved in the entire listing process of the Company, offering an optimal IPO plan with an exclusive service team.

CICC fully tapped into the needs of institutional investors through its comprehensive global sales network, successfully bringing in multiple cornerstone investors, and securing multiple anchor orders before the book-building. As a result, CICC made significant contribution in achieving an ideal valuation for the Company.

This is the first time that CICC participated in an equity transaction of Sino-Ocean Group in Hong Kong, which marks another milestone in the cooperation between the two parties.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide customized and top-notch capital market support to our customers in terms of introduction of global investors, reaching international capital market and promoting global business development.