CICC Assists BYD in US$3.86bn Follow-on Offering

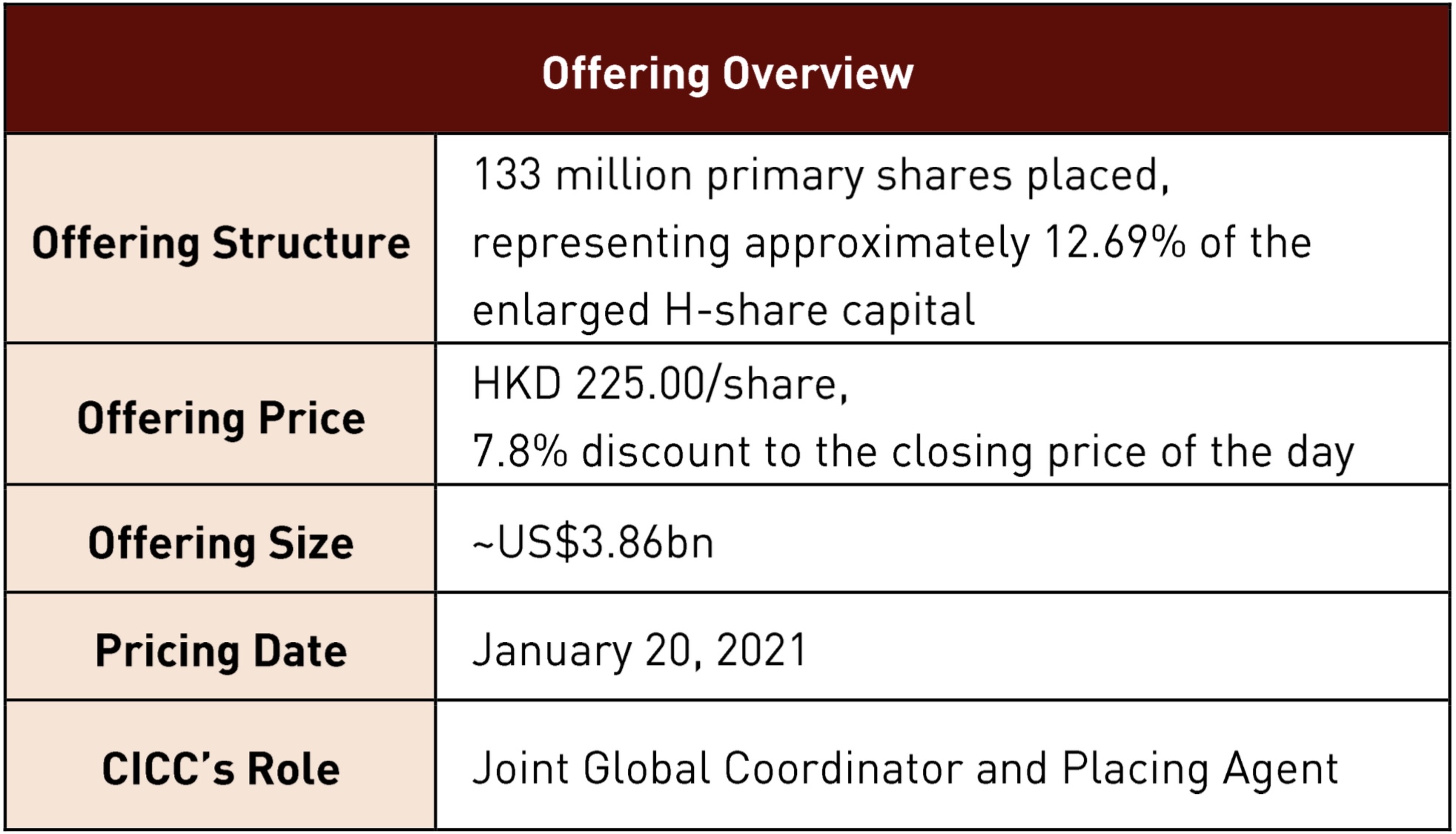

On January 20, 2021, BYD Company Limited (“BYD” or the “Company”, 1211.HK/002594.SZ) priced its US$3.86bn follow-on offering. CICC acted as Joint Global Coordinator and Placing Agent in the transaction.

This is the largest-ever equity financing in Chinese NEV industry, the largest equity financing in Asia auto industry in the past decade, as well as the largest-ever Hong Kong follow-on offering by a non-FIG company.

About BYD

BYD has taken the lead in the NEV market. It has achieved No. 1 in China NEV sales for 7 consecutive years and No.1 in the global NEV sales for 4 consecutive years. BYD is the first auto maker with full coverage of the industry chain, and has successfully launched Blade Battery and new EV model Han in 2020. With top-rate design and advanced technologies, BYD Han has achieved monthly sales of more than 10,000 units, which further consolidated BYD’s industry leadership and enhanced its brand influence.In the first three quarters of 2020, the company achieved revenue of RMB 105bn and net income of RMB 4.9bn.

As the Joint Global Coordinator and the Placing Agent, CICC was responsible for all execution and marketing work streams, including transaction plan designing, due diligence, investor communication and pricing. Under a tight schedule, CICC fully utilized its worldwide sales resources and helped BYD introduce high-quality investors worldwide, realizing zero discount to the average price of last 20 trading days, and achieving an upsize in offering size and an ideal final price.

This has been another successful transaction of CICC providing BYD with full-spectrum capital market services, after assisting its A-share follow-on in 2016 and BYD semiconductors’ private placement in 2020. CICC’s service has won trust and high recognition from the client.

Upholding the values of “Chinese Roots and International Reach”, CICC will leverage its extensive capital market experiences and the capability of seamlessly integrating domestic and overseas businesses to customize the optimal capital market solutions for enterprises to support their strategic development goals.