CICC Assists Alibaba in US$5bn Senior Unsecured Bond Offering

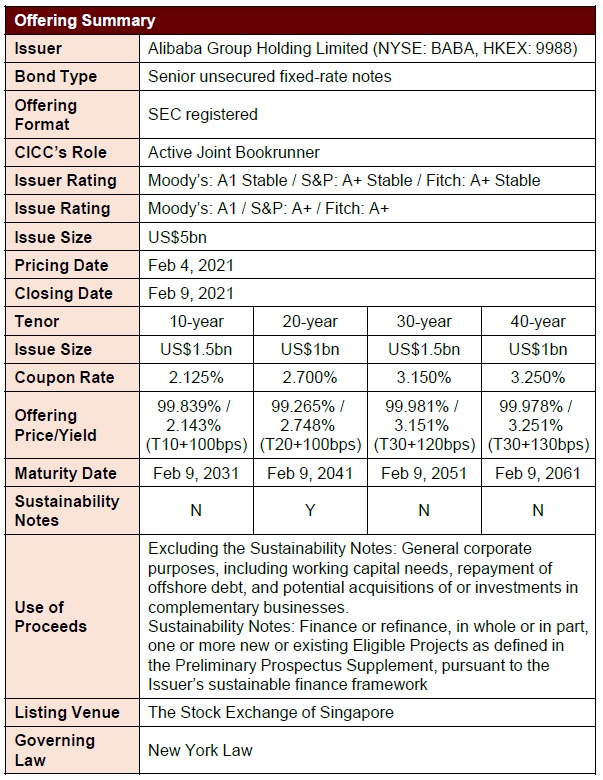

On February 4, 2021, Alibaba Group Holding Limited (the “Company”, NYSE: BABA, HKEX: 9988) successfully priced an US$5.0bn SEC-registered senior unsecured fixed-rate bond. CICC acted as the Joint Bookrunner in this offering.

This milestone deal has broken multiple records in the bond capital market including the largest SEC-registered bond offering by a Chinese enterprise since 2018 (the previous record holder is also BABA in 2017), the lowest pricing spread on international bond issuance by Chinese POE, the first international sustainability bond in Chinese TMT industry, and also its orderbook became one of the largest Chinese international bond issuances.

The issue consists of four tranches: 10-year US$1.5bn 2.125% (YTM: T10+100bps), 20-year US$1.0bn 2.700% (T20+100bps), 30-year US$1.5bn 3.150% (T30+120bps) and 40-year US$1.0bn 3.250% (T30+130bps). The 20-year ESG tranche was particularly appraised by the market investors to promote the global social impact of sustainability.

The offering had a strong book-building momentum. The four tranches narrowed 30, 40, 30, and 30bps respectively from the initial price guidance, resulting in negative new issue premiums between 10-40 bps; especially in the 20-years ESG tranche, which saw the biggest reduction, the final spread was narrowed to the same level as the 10-year tranche at 100bps and was significantly lower than comparable tranches in the industry.

As the only Chinese JBR of the underwriting syndicate, CICC demonstrated its outstanding professionalism and comprehensive service capabilities, leveraged its sales strength in the Asian market and helped the Company to secure multiple large size orders from quality investors, which substantially increased the Asian investor participation and contributed to the investors’ diversity and risk resistance. CICC has gained high praise and full recognition from BABA, and it is another successful example of CICC's long-term international professional service to quality market-leading Chinese enterprises.

Alibaba is a world's leading technology company; after over 20 years of development, Alibaba has transformed from an essential e-commerce platform to the fundamental tech infrastructure of the digital ecosystem that encompasses digital commerce, financial technology, intelligent logistics, cloud computing and big data.

Alibaba was listed on NYSE in 2014. In the past 6 years, its revenue grew by over 750%, while its market cap went from US$170 billion at U.S. IPO to nearly US$700 billion. Since Alibaba’s last issued USD bond in 2017, Alibaba’s business has continued to grow exponentially. Its digital structure and fundamentals expansion has increased diversification in its business revenues and economic values to all the participants in the Alibaba Digital Economy. Alibaba aspires to become a “good” company that will last for at least 102 years, and has already set its vision for 2036: to serve 2 billion world-wide global consumers, empowering 10 million businesses’ to profit and to have created more than 100 million jobs.

Following China Ministry of Finance’s international sovereign bond issuance, CICC, once again, acted as the only Chinese investment bank in the underwriting syndicate, and assisted in the jumbo-deal issued by the world’s leading company in the industry, which reflected CICC’s professional capabilities in national strategy facilitation, and international financing product and all-round investment banking services for industry leading company.

As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.