CICC Assists Joinn in Listing on the Main Board of HKEX

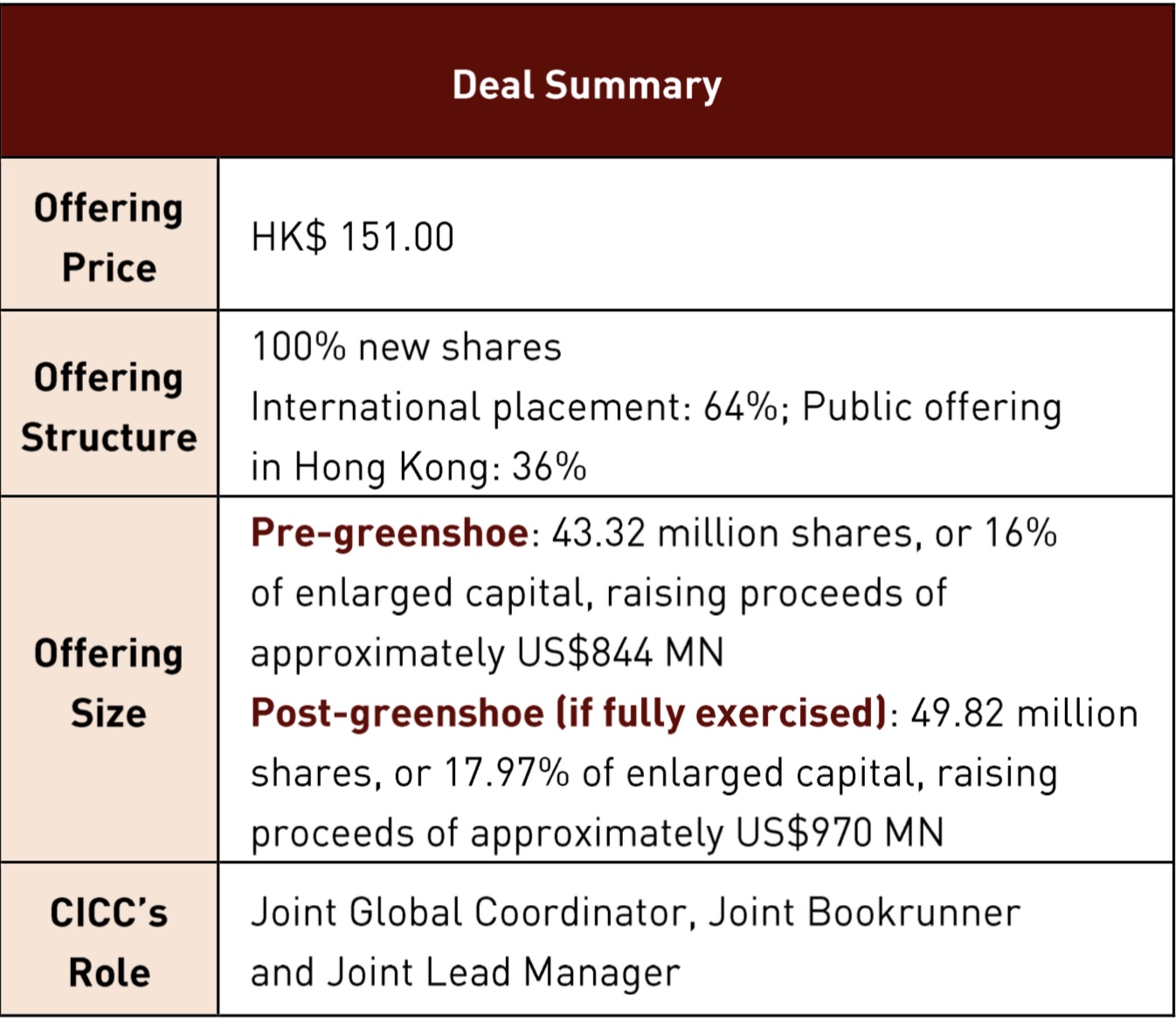

JOINN LABORATORIES (CHINA) CO.,LTD. (“Joinn” or “the Company”, 6127.HK) is successfully listed on Hong Kong Stock Exchange on February 26th, 2021. The pre-green shoe offering size was US$844 million and the post-green shoe offering size is US$970 million (the Offering). CICC acted as Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager. In this project, CICC fully leveraged its integrated capabilities to provide the client with a full spectrum of financial services, helping it achieve its strategic goals.

Setting out as a CRO specialized in pharmacology and toxicology studies for innovative drugs in China, the Company has now become the largest CRO in non-clinical drug safety assessment in China with a market share of 15.7% in terms of revenues in 2019. The Company has achieved robust growth and profitability at scale in the past years, and was generally recognized by investors.

As the Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager of the Offering, CICC leveraged its deep understanding in the Hong Kong's capital market and its rich experience in IPO project execution during the issuance. CICC fully tapped the needs of investors and introduced a number of high-quality cornerstone investors, efficiently converting bookkeeping orders and helping the company achieve a high-end pricing, which led to a successful completion of the issuance.

About Joinn

Joinn is a leading non-clinical CRO focused on drug safety assessment. the Company is also in the process of expanding the Company's offerings to an integrated range of services covering discovery, pre-clinical and clinical trial stages in the drug R&D service chain. the Company's non-clinical studies refer to pharmaceutical R&D studies other than clinical trials conducted on human subjects. Such non-clinical studies encompass all major stages of the pharmaceutical R&D process, including discovery, pre-clinical and clinical trial stages. Setting out as a CRO specialized in pharmacology and toxicology studies for innovative drugs in China, the Company has now become the largest CRO in non-clinical drug safety assessment in China with a market share of 15.7% in terms of revenues in 2019, according to Frost & Sullivan.

With over 25 years of operating history, the Company has accumulated extensive experience in regulatory requirements for new drug. Building upon the Company's core competency in drug safety assessment, the Company has been expanding the Company's service offerings with a view to becoming an integrated pharmaceutical R&D service platform capable of providing a comprehensive portfolio of CRO services including nonclinical studies, clinical trial and related services, and research model business.

In this IPO, CICC has won high praise and extensive recognition from the client in this deal. As a leading investment bank with “Chinese Roots, International Reach”, CICC will continue to utilize its capital market expertise as well as its seamless cooperation of onshore and offshore businesses to provide continuous support to our customers in terms of introduction of global investors, reaching international capital market, and promoting global business development.