CICC Assists in the Completion of the Privatization of Huifu Payment Limited

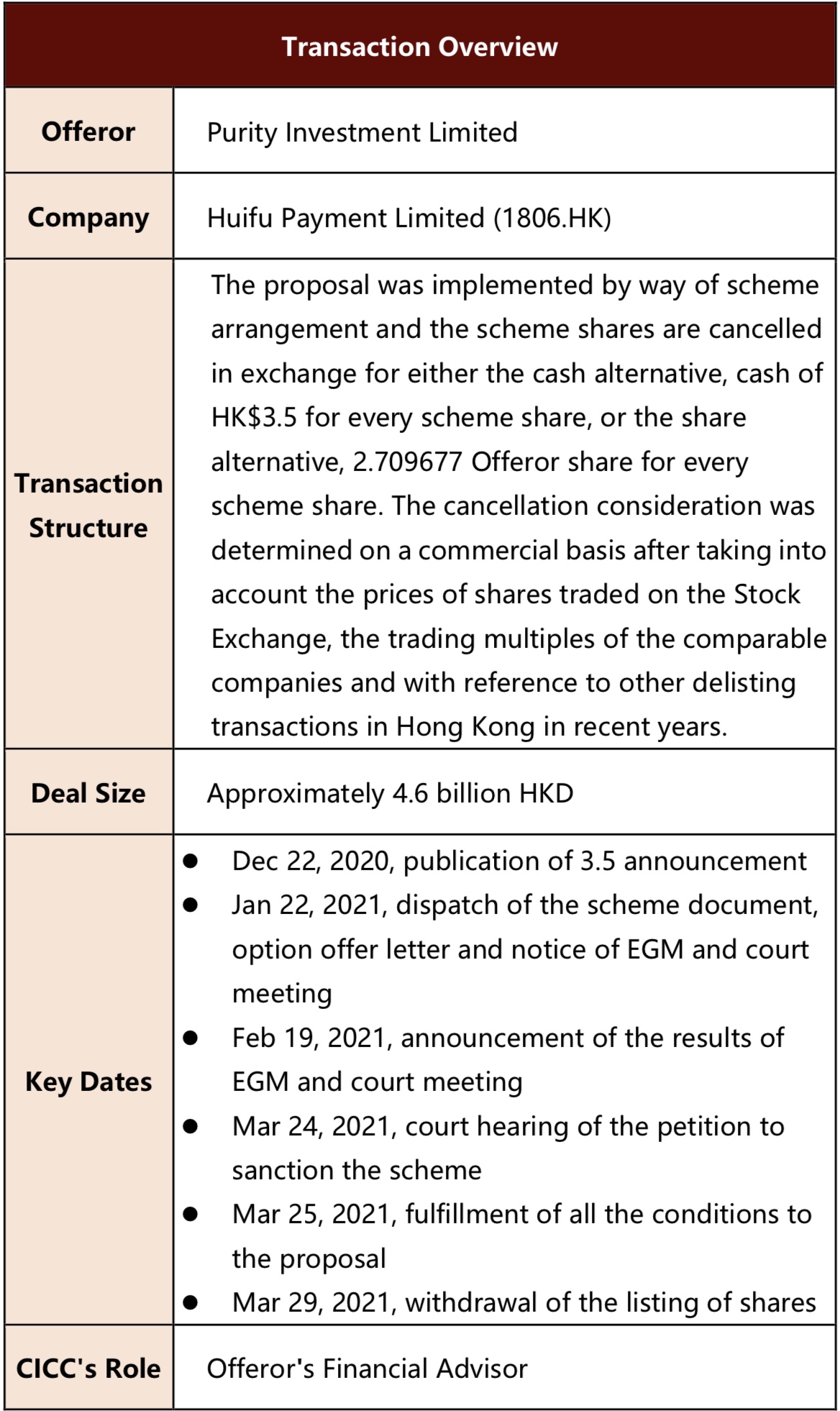

CICC recently successfully assisted in the completion of the Privatization of Huifu Payment Limited. CICC acted as Offeror’s Financial Advisor in the transaction.

This transaction is the first privatization of non-bank payment institution in Hong Kong stock market, and it is a management buyout deal. This transaction consideration contains both Cash Alternative and Share Alternative for all the scheme shareholders. The Share Alternative is conducive to ensuring that shareholders continue to invest in the company‘s digital business focusing on aggregate payment and meet the demand of long-term interests; Cash Alternative is conducive to ensuring the demand of shareholders for cash under the uncertain market conditions. IUs (irrevocable undertaking) from the top 6 major shareholders were obtained before 3.5 announcement, which enhances the certainty of the transaction.

Considering the transaction was initiated by the Management and original IPO investors hold significant stakes in Huifu Payment, CICC took the lead in designing the transaction structure innovatively:

Cash or share alternatives: CICC dedicatedly structured the consideration for scheme shareholders via either cash or share consideration, greatly reducing the total amount of funds required for the Offeror and also meeting the business demands of original IPO investors to retain the company stock after privatization.

Securing pre-consent from 6 important shareholders expeditiously before 3.5 announcement (within 4 days): with SFC’s prior consent and CICC’s coordination, the Offeror communicated in advance with specific pre-IPO shareholders before 3.5 announcement. After 4 days’ of communication, the Offeror obtained IUs (irrevocable undertaking) from the top 6 major shareholders including Bain Capital, Fidelity Eight Roads, Walden and other well-known domestic and foreign institutions to support the transaction, which in advance helped to obtain majority approval from independent shareholders, enhancing the certainty of the transaction and setting a record in the history of Hong Kong privatization deals in terms of quantities of IUs in recent years.

The timetable was highly tight considering several holidays in between such as Christmas, New Year and the Spring Festival. To meet the expected schedule and with the help of CICC and other advisors, multiple rounds of communication with the Cayman court in advance to lock up the court meeting date were conducted; the circular was successfully issued within one month after 3.5 announcement with intensive shareholder communication finalized during the Spring Festival which earned public shareholders’ recognition. It only took 4 months since 3.5 announcement on Dec 23, 2020 to delisting date by the end of March, 2021. CICC coordinated with all parties to efficiently complete the transaction.

CICC enjoys a leading position in HK-share privatizations. Among the top 15 completed privatizations of HK-share listed Chinese enterprises during the last 5 years, CICC led the execution of 9 deals, which accounted for 60% in terms of the quantity. In 2020, around 80% privatizations of HK-share listed China enterprises were conducted by CICC when counted by deal value. In recent years, renowned privatizations led by CICC include CNBM’s merger of Sinoma via share swap, the privatization of China-Agri, O-Net Technologies, ASMC, Intime Retail (Group), etc.

Capitalizing on our extensive experience in privatizations and leveraging our innovation in designing deal structure, CICC has successfully completed a number of benchmark deals including the privatization of the merger of CSR and CNR – the first merger between two A+H dual-listed companies via share swap, the privatization of Dalian Wanda Commercial Properties – the largest H-share cash privatization, and the privatization of Haier Electronics by Haier Smart Home – the first ever transaction of an A-share listed company that completed both privatization of an HK-share listed company via share swap and H-share listing by introduction in parallel.

CICC possesses strong communication skills in contacting both domestic and foreign investors and has gained extensive experience in large M&A deals. Shareholders’ approval in general meeting is critical in HK-share privatization deals, while CICC has obtained exquisite know-how and formed long-term relationship with all types of investors in Hong Kong, which is well recognized in market.

Upholding the values of “Chinese Roots and International Reach” and “By the People and For the Nation”, CICC will leverage the rich capital market experiences and the capability of seamlessly integrating domestic and overseas businesses to customize the optimal capital market solutions for enterprises to support their strategic development goals.